Video KYC Solution (V-CIP) for Instant Online Verification

Accelerate customer onboarding with our Video KYC solution. Digitize your entire customer journey, slash costs by 70%, and reduce KYC time by 90%.

Top Challenges with Video KYC Verification Processes

Internet and Device Limitations

Unstable internet and older devices can disrupt the video KYC process.

Privacy Concerns

Individuals worry about data misuse and may feel uneasy using video technology for verification.

User Experience

The video KYC steps can be confusing and time-consuming, particularly for non-tech-savvy users.

Infrastructure and Scalability

Setting up infrastructure and managing large volumes of KYC requests can be costly and complex.

Security and Compliance

Ensuring compliance with regulations and protecting customer data from breaches are critical concerns.

Trusted by 2,000+ companies

Video KYC Solution Features

Significantly reduces the time required for customer verification, making the entire process faster and more efficient.

Checks and APIs:

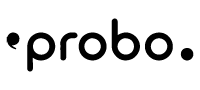

Live Video Call:

Live Video Call:

Real-time customer verification through video interaction.

OCR Technology:

OCR Technology:

Optical Character Recognition (OCR) for instant data extraction and document verification.

Instant PAN Validation:

Instant PAN Validation:

Verification of PAN details through NSDL.

Provides a higher level of security compared to traditional methods, reducing the risk of fraud and personal data misuse.

Checks and APIs:

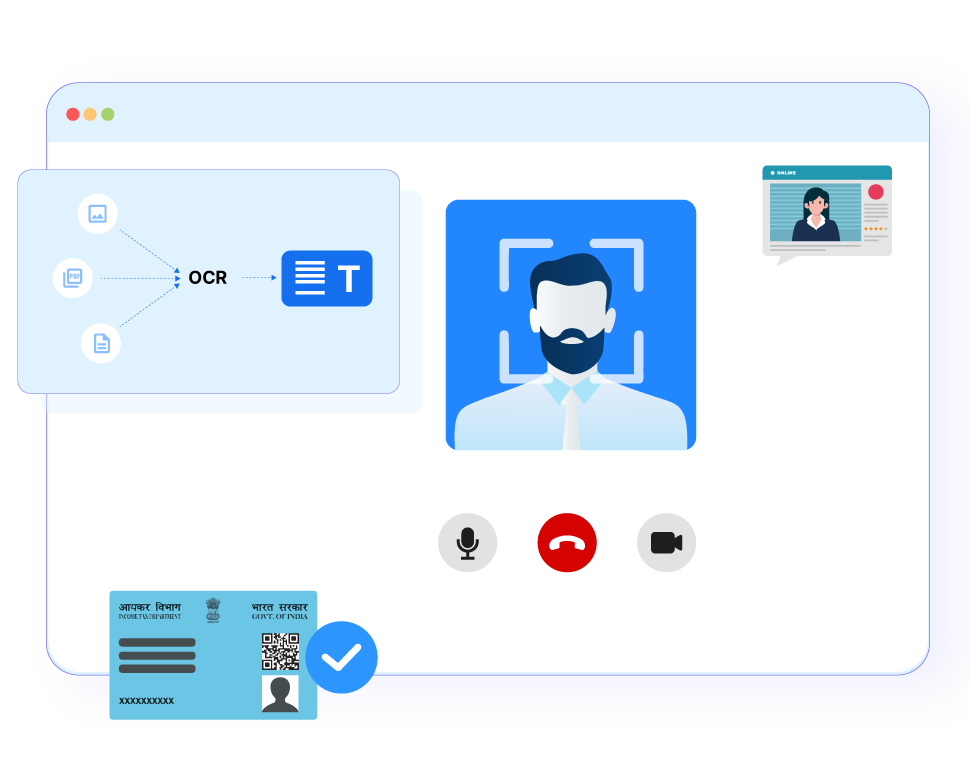

Face Match API:

Face Match API:

Real-time selfie face match with national identity documents to ensure the person’s identity.

Liveness Detection:

Liveness Detection:

Ensures the person on the call is real and physically present.

End-to-End Encryption:

End-to-End Encryption:

Secure audio and video encryption during the interaction.

Reduces operational costs by eliminating the need for physical infrastructure and manual processes.

Checks and APIs:

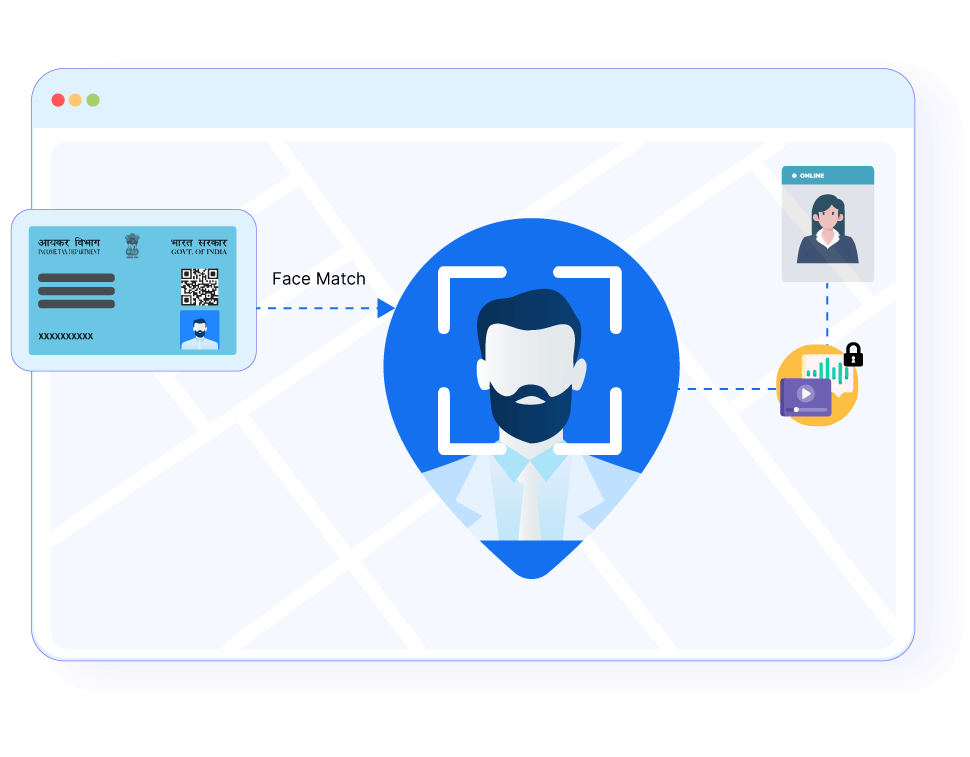

Automated Workflows:

Automated Workflows:

Automates document verification and other KYC processes to reduce manual effort.

Geo-Tagging:

Geo-Tagging:

Ensures the customer’s physical presence in India, removing the need for physical branches.

Ensures adherence to regulatory requirements, minimizing the risk of non-compliance penalties.

Checks and APIs:

Aadhaar Offline Verification:

Aadhaar Offline Verification:

Real-time Aadhaar verification using OKYC and XML generation date validation.

Regulatory Compliance:

Regulatory Compliance:

Meets guidelines set by SEBI, RBI, and other regulatory bodies.

Why Reputed Brands Trust Us?

Clear Insights, Clear Decisions.

Business growth accelerates when you build and nurture trust within your team. Empowering employees through trust fosters collaboration, drives innovation, and strengthens long-term success

Lakhs calls per day

Call Conversions

Drop off rate reduced

Call Duration

Video KYC Verification: All You Need To Know

This article will explain what a Video KYC is, as well as answer common questions about Video KYC.

Table of Contents

Click a topic to scroll directly to it.

Definition of Video KYC

Video KYC (Know Your Customer) is an electronic method for verifying a customer’s identity through a live video call. This process allows institutions to authenticate customers remotely, ensuring compliance with regulatory standards while enhancing the convenience and speed of customer onboarding.

Evolution of KYC Practices

Traditional KYC involved manual verification of physical documents, often requiring customers to visit branches. This method was not only time-consuming but also prone to errors and fraud. With technological advancements, KYC practices have evolved significantly. The introduction of Digital KYC and subsequently video KYC has revolutionised the verification process, making it more secure, efficient, and user-friendly.

Try Fast, Accurate, & 100% Digital Checks Now

How Video KYC Works?

The video KYC process involves several key steps to ensure a secure and efficient verification of customer identity:

- Initiation: The customer begins the video KYC process through a secure online portal or mobile app. They are required to provide initial information and consent for the video KYC process.

- Scheduling: Customers can schedule a live video call with a KYC representative or join an available session immediately.

- Live Video Call: During the call, the KYC representative verifies the customer’s identity by checking their documents and comparing them with the individual present on the video.

- Document Verification: The customer is asked to display their identification documents (e.g., Aadhaar, passport, driver’s licence) to the camera. Advanced OCR (Optical Character Recognition) technology is used to extract and verify information from these documents.

- Liveness Check: The representative performs a liveness check to ensure the person on the call is real and physically present. This step involves asking the customer to perform certain actions, such as blinking or turning their head.

- Data Capture and Storage: The session is recorded, and relevant data is securely stored for compliance and future reference.

Benefits of Video KYC

Efficiency and Speed

Video KYC significantly reduces the time required for customer verification. The entire process, from initiation to completion, can be conducted within minutes, compared to days or weeks for traditional KYC methods. This efficiency not only accelerates customer onboarding but also enhances operational workflows, allowing institutions to handle higher volumes of verifications without compromising accuracy.

Improved Customer Experience

By enabling remote verification, video KYC offers a seamless and convenient experience for customers. They can complete the process from the comfort of their homes, without the need to visit a physical branch or submit physical documents. This convenience is particularly beneficial in the context of the ongoing digital transformation, where customer expectations for fast and efficient service are higher than ever.

Enhanced Security and Fraud Prevention

Video KYC incorporates advanced technologies such as AI, biometric authentication, and OCR to ensure robust security measures. These technologies help detect and prevent fraudulent activities by verifying the authenticity of documents and the identity of the person in real time. The liveness check further enhances security by ensuring that the individual is physically present and not using pre-recorded videos or photos.

According to a report, the video KYC market is projected to grow at a CAGR of over 20% from 2021 to 2027, driven by the increasing demand for secure and efficient customer verification solutions. This growth underscores the significant benefits and trust in video KYC as a reliable method for identity verification.

Try Fast, Accurate, & 100% Digital Checks Now

Video KYC Regulations in India

RBI Guidelines

In India, the Reserve Bank of India (RBI) has established comprehensive guidelines for video KYC, specifically through the Video-Based Customer Identification Process (V-CIP). Key elements of these regulations include:

- Secure Video Calls: The V-CIP mandates the use of encrypted video calls to ensure the privacy and security of customer data during the verification process.

- Geotagging: The customer’s location must be verified using geotagging to ensure they are physically present in India during the video call.

- Document Verification: Customers are required to display their identification documents during the video call. These documents are verified in real-time using OCR technology to extract and authenticate the information.

- Liveness Check: A liveness check is performed to confirm that the customer is physically present and not using pre-recorded videos or images. This step may include actions such as blinking or turning the head.

- Facial Recognition: The captured images are compared with the photographs on the provided identification documents using facial recognition technology to ensure a match.

- Audit Trail: The entire process is recorded and stored securely, providing an audit trail that ensures compliance with regulatory requirements.

Key Features of AuthBridge’s Video KYC

- Liveness Detection: Ensures the physical presence of the customer during the verification process, preventing fraud through pre-recorded videos or images.

- OCR Technology: Automatically extracts data from identity documents, reducing manual errors and speeding up the verification process. This technology is particularly useful for verifying PAN cards and other government-issued IDs.

- Geotagging: Confirms the customer’s location, ensuring they are physically present in India during the video call, which is a regulatory requirement.

- AI and Biometric Authentication: Uses artificial intelligence and biometric data such as facial recognition to enhance security and accuracy. These technologies help in detecting fraudulent activities by verifying the authenticity of the customer’s identity in real time.

How does AuthBridge’s Video KYC work?

- Customer Application Initiation: The customer initiates the video KYC process through an online portal or a mobile app. This step involves the customer providing initial information and consenting to the video KYC process.

- Instant PAN Card OCR and Verification: The system uses OCR technology to instantly verify the customer’s PAN card. This step involves scanning the PAN card and extracting the relevant information automatically.

- Aadhaar Verification: The customer’s Aadhaar details are verified either through OTP-based eKYC or offline Aadhaar verification. This ensures that the customer’s identity is verified against a reliable government database.

- Geolocation Tracking: The system tracks the customer’s geographical location to ensure compliance with regulatory requirements. This step involves using GPS technology to geotag the customer’s location during the video call.

- Agent Assignment: An agent is automatically assigned to conduct the video verification. The agent is responsible for verifying the customer’s identity by checking their documents and comparing them with the individual present on the video call.

- Random Question Verification: During the video call, the agent asks random questions to the customer to ensure they are physically present and attentive. This step involves asking the customer to perform certain actions, such as blinking or turning their head, to confirm their liveness.

- Liveness Check and Screenshot Capture: The system captures screenshots and performs a liveness check to confirm the customer’s identity. This step ensures that the customer is not using pre-recorded videos or images.

- KYC Verification Report Generation: A comprehensive report is generated and securely stored for compliance and future reference. This report includes details of the video KYC process, including the customer’s identity verification and the results of the liveness check.

AuthBridge Video KYC Benefits

- Cost Reduction: Video KYC can reduce operational costs by up to 70% compared to traditional KYC methods. This is achieved through automation and reduced reliance on physical infrastructure.

- Efficiency and Speed: The process reduces KYC turnaround time by up to 90%, enabling faster customer onboarding. This is particularly beneficial for financial institutions that need to onboard large numbers of customers quickly and efficiently.

- Compliance: Ensures adherence to AML regulations and data protection laws, providing peace of mind to financial institutions and their customers. The solution is designed to meet regulatory requirements set by the RBI and other governing bodies.

- Fraud Prevention: Advanced security measures help in detecting and preventing identity and financial fraud. The use of AI, biometric authentication, and geotagging ensures that only legitimate customers are onboarded.

Try Fast, Accurate, & 100% Digital Checks Now

AuthBridge Video KYC Applications

- Banking and Financial Services: Streamlines customer onboarding for banks, NBFCs, and other financial institutions. This includes opening new accounts, issuing loans, and providing other financial services.

- Insurance Providers: Enhances the verification process for policyholders, reducing fraud and expediting claims processing. Video KYC can be used for onboarding new policyholders and verifying existing ones.

- E-commerce and Remote Services: Verifies users for high-value transactions and services, enhancing trust and security. This includes verifying customers for online purchases, remote services, and other e-commerce activities.

- Cryptocurrency Exchanges: Ensures compliance with AML regulations, securing transactions. Video KYC helps in verifying the identities of users on cryptocurrency platforms, reducing the risk of fraud and money laundering.

- Real Estate and Car Rentals: Authenticates customers, reducing fraud in rental and real estate transactions. Video KYC can be used to verify tenants, buyers, and renters, ensuring that only legitimate customers are allowed to transact.

How to Do Video KYC?

AI-powered Customer Identification Every Step of the Way

Step by step guide to Video KYC Process

Step 1

Customer Application Initiation

Step 2

Instant PAN Card OCR and Verification

Step 3

Offline Aadhaar Verification/ OTP based eKYC

Step 4

Geolocation Tracking of Customer

Step 5

Automatic Agent Assignment by REs

Step 6

Random Question Verification

Step 7

Screenshot capture and liveliness check

Step 8

Generating KYC Verification Report

Regulatory Requirement for Video KYC

Video KYC Solution for Every Regulatory Requirement

Discover AuthBridge’s RBI and SEBI-compliant Video KYC (V-KYC) solution, specifically designed to meet regulatory requirements while delivering a seamless, secure, and efficient verification process. Our solution ensures compliance with the highest industry standards while enhancing the speed and accuracy of customer onboarding through advanced technology and robust security protocols.

| Regulatory Requirement | Video KYC Solution |

|---|---|

| Live photo of the customer | Screenshot capture for customer's physical presence |

| PAN image capture & Verification | Instant PAN validation from NSDL with name match |

| Face match | Real-time selfie face match with NID to generate face match score |

| Identity details validation | OCR enabled data extraction and verification with high image quality processing |

| Geo tagging | Geo-location capture to ensure customer’s physical presence in India |

| Randomizing of questions | Customizable security questions and activities using workflow |

| Aadhaar number masking | Real-time redaction of Aadhaar number |

| Geo-stamped Video storage | End to end encrypted video file storage, date and time stamping, archiving and labeling |

| Prior consent of customer | Compliance with GDPR and other data privacy frameworks |

| Aadhaar offline verification | OKYC and XML generation date validation |

| Secure interaction | End-to-end audio and video encryption |

Video KYC Verification Solution

Plug n Play Integration

100% Compliant

End-to-end data encryption with 256 algorithm

Auto Purge Policy

Dashboard for Concurrent Audit

Face Verification

Geo-tagging

OCR (Optical Character recognition)

Document Verification with Digilocker

IP Address Spoofing Prevention

RE Agent Training

Remote Customer Onboarding

As per RBI’s guidelines, RBI Regulated Entities (REs) can do Video KYC verification of their customers with their consent.

V-CIP stands for Video KYC for Customer Identification Process.

Only authorised personnel with a legitimate business need will have access to your KYC information.

V-CIP or Video KYC is compliant with RBI’s latest guidelines only when it is facilitated by RBI Regulated Entities (REs) in consent with the customer.

The companies will usually reschedule the call or retry the process within a specific timeframe.

Video KYC (Know Your Customer) is a digital verification process where you confirm your identity through a live video call with a representative.

Contact Sales

Ready to Explore AuthBridge for your business?

We’d love to show you how AuthBridge can help your business. Fill out the form and we’ll be in touch within 24 hours.

- Assess your team’s needs

- Learn more about AuthBridge's Products & Benefits

- Discuss pricing options

Home » Video KYC

Stay Informed

Keep yourself updated with the latest innovations in BGV & Authentication Technology from India’s leading Background Verification Company

Sign up for our newsletter

Hi! Let’s Schedule Your Call.

To begin, Tell us a bit about “yourself”

The most noteworthy aspects of our collaboration has been the ability to seamlessly onboard partners from all corners of India, for which our TAT has been reduced from multiple weeks to a few hours now.

Greenlam