Identity fraud and unlawful activities are increasing at an alarming rate, and organizations are emphasizing stringent due diligence and KYC processes for user identification and onboarding. In India, with its large demographic and plentiful financial institutions, a reliable KYC system is essential for attaining profitability, controlling risks, and adhering to regulations.

Organizations across sectors are opting for robust KYC solutions to drive onboarding decisions and prevent repercussions associated with identity fraud.

These solutions range from account opening, lending, collections, insurance, third-party onboarding, and candidate onboarding to risk management and compliance.

What is KYC?

KYC stands for Know Your Customer. It refers to the process of identity verification of all customers, clients, individuals or third parties during the onboarding or verification process or while conducting transactions.

The Reserve Bank of India (RBI) has made KYC mandatory for all banks, financial institutions, and other digital payment companies that carry out financial transactions. KYC standards are designed to ensure protection against fraud, corruption, money laundering, and terrorist financing.

Government Rules & Regulations around KYC

The UIDAI has established certain guidelines for the process of verifying the identity of an individual, known as “Know Your Customer” or KYC. These guidelines are intended to ensure the authenticity of the information provided by individuals during the Aadhaar enrollment process and to prevent identity fraud.

KYC guidelines as per the UIDAI

The UIDAI has put in place KYC (Know Your Customer) regulations to help protect against criminal and suspicious activities and reduce the possibility of fraud. In India, the Securities and Exchange Board of India (SEBI), Reserve Bank of India (RBI), and Insurance Regulatory and Development Authority of India (IRDAI) are responsible for overseeing the BFSI industry and have implemented specific policies to verify the identities of individuals.

This also allows companies to understand better their customers’ financial transactions to serve them better and manage risks more effectively. The guidelines mandate the following processes:

Identity verification

OTP verification

Some additional guidelines for KYC as per SEBI, RBI, and IRDAI are:

Risk profiling

AML (Anti-Money Laundering) checks

Note: These guidelines may change from time to time, and it is advisable to check the respective websites for the most up-to-date information.

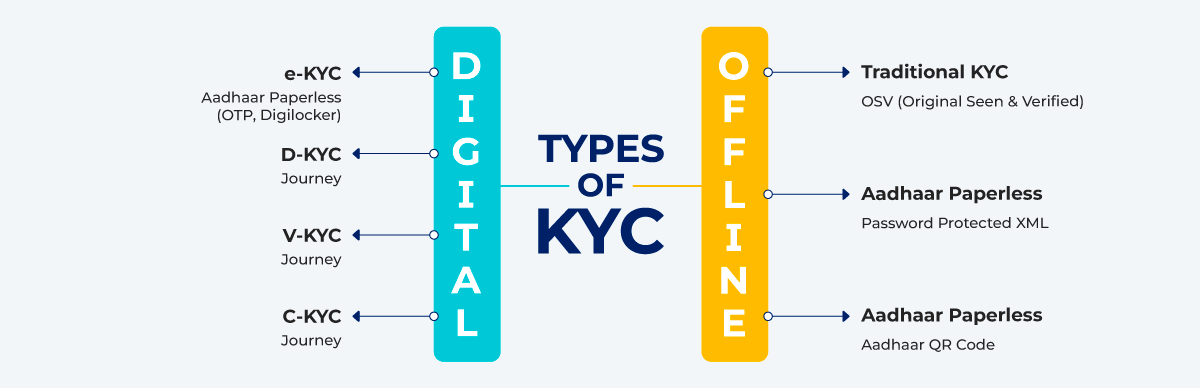

Different Types of KYC with Advantages & Challenges

Offline KYC

Paper-based KYC

This is the most traditional way to validate a user’s identity during the onboarding process. The verification process happens in person where customers/individuals submit physical, self-attested copies of their documents — Proof of Address (POA) and Proof of Identity (POI). This process demands a physical connection with the customer for document collection and signing.

- Advantages

The process is traditional and familiar to both customers and institutions, especially in rural areas that are untouched by digitization.

- Challenges

As the process is manual, the process is cost-intensive and prone to operational delays and inefficiencies. Furthermore, there is an extra challenge of storage of the physical documents and their maintenance.

Aadhaar Paperless Offline E-KYC

,

Aadhaar Offline KYC is not the same as physical KYC. This process utilizes an offline form of Aadhaar and eliminates the need to connect to the UIDAI database. An Aadhaar XML/PDF-based authentication or QR Code-based demographic authentication— Name, Address, DOB, gender, registered phone number, photograph — can be conducted without the use of biometrics.

- Advantages

Offline KYC is accessible to all kinds of private BFSI entities. It is convenient for the users/customers to download and share the Offline Aadhaar from the UIDAI website with consent to be further utilized for verification and authentication purposes.

- Challenges

In this method, a customer’s mobile phone should be linked to their Aadhaar as customers receive an OTP on their phone number.

Online KYC

Aadhaar eKYC

There are two ways to conduct Aadhaar eKYC in an online mode — OTP-based and Biometric-based. In OTP-based verification, customers/individuals first have to ensure that their mobile number is linked to their Aadhaar. On the other hand, in biometric-based verification, UIDAI-certified biometric scanners are used for authentication. Learn more about the power of Aadhaar e-KYC here.

- Advantages

This method is 100% digital, faster, cost-effective, and requires no contact with a customer. Aadhaar-based eKYC helps businesses stay compliant with the safeguards set by regulatory bodies.

- Challenges

For the successful completion of this process, a dedicated technology infrastructure is required which eventually leads to a high cost when compared to other KYC solutions.

Digital KYC

In digital KYC, a live photo of the customer and Officially Valid Documents (OVDs) are captured. The process happens in the presence of an authorized official. An individual can share digital copies of Aadhaar, PAN, DL, or other ID documents for KYC directly on the institution’s portal or other mediums. The submitted details are verified against the captured data.

- Advantages

This is a paperless and cost-effective method as the end-to-end process is digital and automated. Customers can complete the verification process without having to visit a physical location. The process is faster and more efficient as it eliminates the need for manual verification, eventually reducing the risk of errors and fraud.

Increased security: Digital KYC uses advanced technology such as biometric authentication and digital signatures to ensure the authenticity of identity information and reduce the risk of identity fraud.

- Challenges

The identification process is dependent on manual intervention as the RE agent is involved. This eventually leads to subjectivity and inefficiencies.

Central KYC (CKYC)

Central KYC Registry is a centralised repository of KYC records, managed by the Central Registry of Securitisation Asset Reconstruction and Security Interest of India (CERSAI). As soon as an individual submits the KYC documents, he/she is registered in the repository with a unique CKYC number. The number can be quoted instead of submitting physical KYC documents for any financial transaction and the CKYC repository all financial institutes can easily access the CKYC repository to validate customer KYC.

- Advantages

Once customer KYC details are registered with CKYC, they get a 14-digit KYC Identification Number (KIN) number that can be quoted for any kind of financial transaction – eliminating the need for submitting the KYC documents time and again. The financial institutions get the ease of accessibility and customers do not have to provide the same information multiple times – ultimately improving their conveniences.

- Challenges

Financial institutions must comply with a range of regulations when using the CKYC database, which can be complex and time-consuming.

Video KYC

Video KYC is a completely paperless and presence-less KYC process for compliant and fraud-free authentication. During the video call, the representative will verify the customer’s identity by comparing the provided information to the information present on the government-issued ID and conducting a live facial recognition comparison.

The process is designed to make it easy for customers to complete the KYC process from the comfort of their own home or office, without having to visit a branch in person.

- Advantages

Video KYC enables end-to-end onboarding journeys and also ensures seamless customer experience. It is considered as the most convenient and efficient way of completing the KYC process as it eliminates the need for physical documentation and face-to-face interaction. Some of the benefits of video KYC are increased customer convenience, reduced time and cost of compliance, and improved security.

- Challenges

In Video KYC, the major challenge is the heavy investment in technology especially when you have not partnered with third-party enablers. This is where AuthBridge, a leading third-party enabler for authentication and verification companies, plays a crucial role.

Re KYC

According to the RBI guidelines, banks may ask for Re-KYC at specific intervals to keep updating the information and records while also maintaining compliance with the regulations. For example, if the customer changes the address, registered phone number or email ID etc., that were submitted at the start of the verification process, the same should be updated in the records through the Re-KYC process.

| Type of KYC | Description | Technology Used | Industry Application | Benefits | Challenges |

|---|---|---|---|---|---|

| Physical KYC | Traditional method involving face-to-face verification and physical document submission. | Minimal | Banking, Real Estate | High reliability, Familiar process | Time-consuming, Higher cost, Physical storage required |

| Digital KYC | Uses digital tools to verify documents and identity online. | OCR, Digital Forms | Fintech, Online Retail | Fast processing, Lower cost, Reduced paper use | Privacy risks, Dependence on internet connectivity |

| Aadhaar-based e-KYC | In India, uses Aadhaar data for instant identity verification through biometric or OTP authentication. | Biometric Scanners, OTP Systems | Banking, Telecommunications | Quick verification, Enhanced security | Limited to India, Regulatory constraints |

| Video KYC (V-KYC) | Remote verification method where identity is confirmed in a live video interaction. | Video conferencing technology | Banking, Financial Services | Reduces travel, Real-time interaction | Requires high-quality video tech, Privacy concerns |

| Central KYC (CKYC) | A standardized process that stores KYC records centrally, accessible by any financial institution registered. | Central Database, Secure Access | Banking, Investment Platforms | Eliminates multiple KYC submissions | High initial setup and maintenance costs |

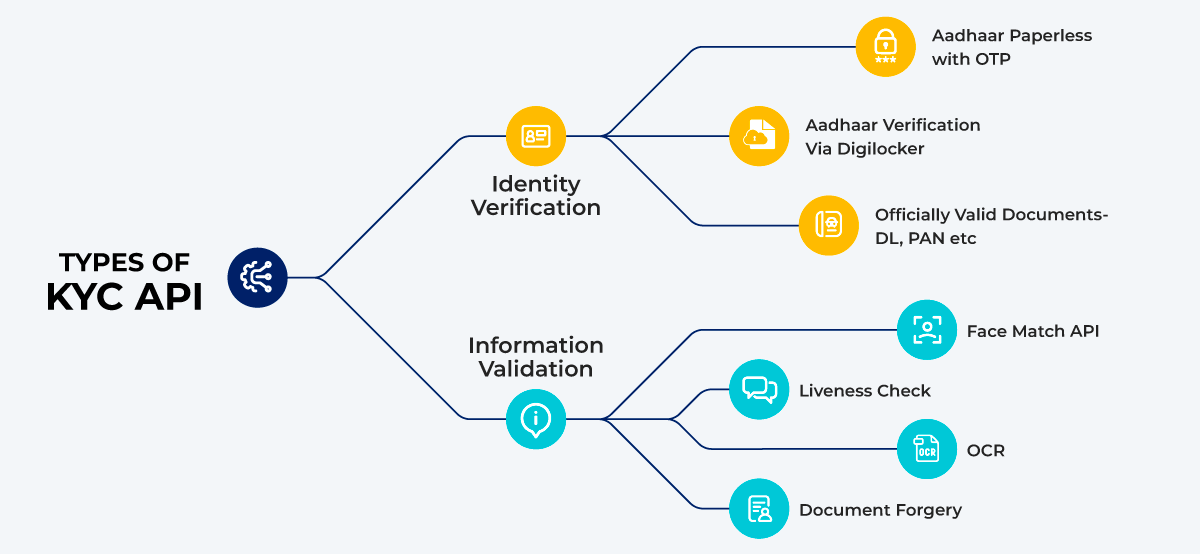

Types of KYC APIs

Identity Verification APIs

Identity verification API enables document authentication and identity verification by validating credentials or identity proofs in real-time. These APIs ensure that there is a real entity or valid business behind a process so that there is no room for fraudulent activities i.e. false authorizations, identity theft, money laundering, and financial crimes. You can prevent verification errors but also enable end-to-end secured KYC verification for the following:

- Aadhaar Paperless with OTP- Only Banks & Telecommunication are allowed

- Aadhaar Verification Via Digilocker

- Officially Valid Documents- DL, PAN, etc

Information Validation APIs

- Face Match API: Face Match API uses facial recognition technology to verify the identity of an individual. It utilizes a live or recorded image of the individual’s face with a reference ID to analyze and compare the biometric data such as facial features, proportions, and patterns, to make the match determination.

- Liveness Check: A Liveness Check API will ensure that an individual is physically present during the verification process and not using a fake or pre-recorded image. It detects if the person is real and not using a photograph, video or mask by analyzing the movements and changes of the person’s face or body in real-time.

- OCR: OCR technology catches document forgery and tampering, sieves fake applications from the real ones, and enables ease of onboarding with automated data capturing.

- Document Forgery: This validates the authenticity of official documents, such as passports, IDs, etc. by analyzing the text, images, and other elements in the documents to detect any signs of tampering or forgery. The data is cross-checked with government databases and other authoritative sources.

Documents Required in Different Modes of KYC

According to the Indian Government guidelines, some key documents serve as ‘Officially Valid Documents (or OVDs) and are used for identity verification. If you are an Indian National, the following documents are accepted as proof of address and proof of identity.

- Passport,

- Driving Licence(dl verification),

- Voter Id Verification

- PAN Card

- Aadhaar Card issued by UIDAI and

- Job card issued by NREGA duly signed by an officer of the State Government

- Letter issued by the National Population Register containing details of name and address.

If identity information relating to the Aadhaar number or PAN submitted by the customer does not have a current address, an individual has to submit the following documents.

- Utility bill not more than two months old (electricity, telephone, post-paid mobile phone, piped gas, water bill);

- property or Municipal tax receipt;

- pension or family pension payment orders (PPOs) issued to retired employees by Government Departments or Public Sector Undertakings, including address.

- A document issued by a State Government or Central Government Department, a regulatory body, a public sector undertaking, a scheduled commercial bank, a financial institution, or a listed company, granting an employee the right to officially occupy a space, typically under a leave and license agreement.

- Provided further that the customer shall submit an Aadhaar or OVD updated with the current address within a period of three months of submitting the above documents.

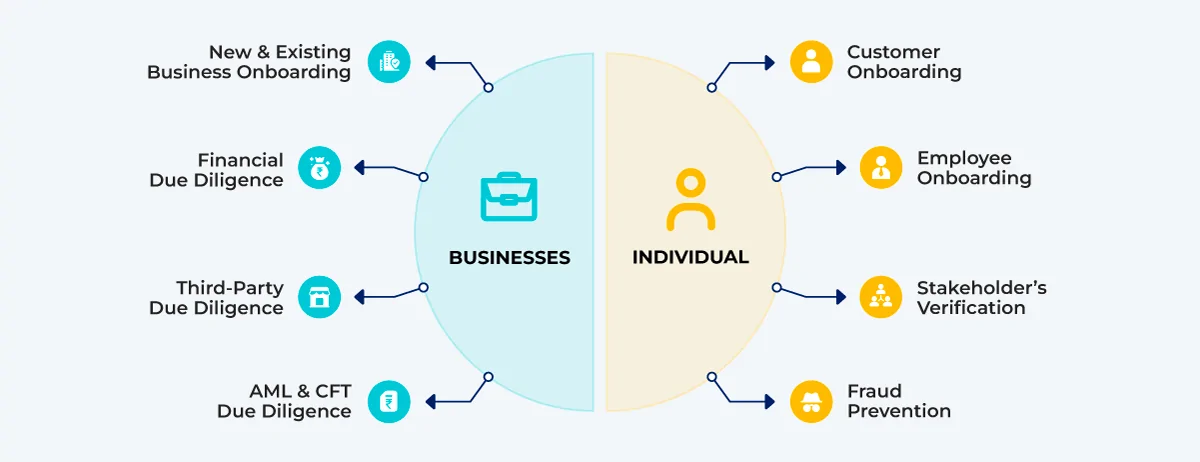

Where is KYC needed and Why?

For Individual

- Customer Onboarding: Financial institutions leverage KYC solutions to validate customers’ identities and assess their potential risks for money laundering or financing terrorism. The purpose of KYC in customer onboarding is to ensure compliance with anti-money laundering regulations and to protect the institution from potential legal and reputational risks.

- Employee Onboarding: The KYC process can include background checks, which help to ensure that new hires have a clean criminal record and do not pose a threat to the company or its employees. KYC in employee onboarding is crucial for ensuring a safe and compliant workplace, protecting sensitive information, and maintaining the integrity of the company.

- Stakeholder’s Verification: Businesses across sectors need KYC solutions for the verification of key business stakeholders i.e. clients, business partners, investors, etc. to ensure their legitimacy and keep themselves on the right side of the law. The process typically involves collecting personal and company information and verifying it against reliable sources such as government databases, business registries, and credit bureaus to ensure compliance with legal and regulatory requirements.

- Fraud Prevention: The goal of KYC for fraud prevention is to minimize the risk of fraudulent activities and to protect the organization from financial losses, legal liability, and reputational damage.

For Businesses

- New & Existing Business Onboarding: Ensuring that only legitimate businesses are being onboarded is a tough task. You cannot risk your business reputation and profitable returns by associating yourself with illegitimate ventures that are on false fronts for bad reputation, corruption, or money laundering. KYC/KYB compliance contributes to informed decision-making by providing valuable insights and actionable data to decision-makers.

- Financial Due Diligence: Assessing the financial health of a business is crucial otherwise it could result in a loss of ROI, time, and reputation. It is crucial to leverage KYC/KYB solutions to evaluate whether an individual/business partner is a good prospect or in any financial trouble.

- Third-Party Due Diligence: Third-party stakeholders such as suppliers, vendors, dealers, distributors, vendors, and merchants play an integral part in managing different functions of the supply chain. Enabling third-party due diligence with robust KYC solutions helps in mitigating identity thefts that can expose a business to reputational, regulatory, and financial risks.

- AML & CFT Due Diligence: Ensuring AML and CFT compliance is essential to protect the integrity of the business and the financial framework. A robust KYC process can help in battling fraud and eliminating money laundering, terrorist financing, and other financial misconduct.

Need for KYC in Different Industries

| Industry | Need for KYC | Common KYC Method | Purpose of KYC |

|---|---|---|---|

| Banking | High | Digital KYC, V-KYC | Prevent fraud, comply with anti-money laundering laws |

| Telecommunications | Medium | Aadhaar-based e-KYC | Verify identity, contract authenticity |

| Insurance | High | Central KYC (CKYC) | Risk assessment, policy management |

| Real Estate | High | Physical KYC | Anti-fraud, legal compliance |

| Healthcare | Medium | Digital KYC | Patient verification, insurance claim processing |

- Gaming: KYC in gaming not only helps in onboarding genuine users, but also prevents gaming frauds such as multi-accounting, underage gaming, location spoofing, collision, and much more. Gaming companies can comply with various anti-money laundering and anti-fraud regulations to provide a better and more secure experience to their players.

- Banking, Financial Services and Insurance: In such industries, there is an inherent risk of financial fraud and money laundering. KYC process helps banks and other financial institutions obtain information about their customers’ identity thereby ensuring their services and government regulations are not misused.

- Retail, FMCG, Logistics: In the logistics industry, KYC can help to ensure the longevity of the supply chain by verifying the identities of suppliers and partners. KYC helps to ensure the security of sensitive customer information by verifying the identity of the customer and ensuring that their information is protected.

- Telecommunications: KYC can help to ensure the security of the network by verifying the identities of customers and reducing the risk of illegal activities. Telecommunications companies can reduce the risk of lost revenue due to fraudulent activities, such as identity theft or unauthorized usage.

AuthBridge’s Robust KYC Solutions

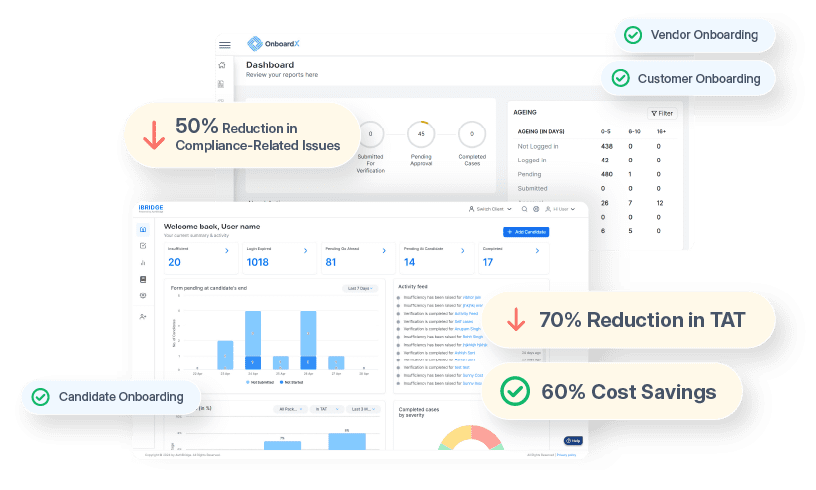

No matter if you are onboarding employees, third parties, or customers, it is always best to invest in a new-age customizable solution that can serve you with digital, biometric, and or video KYC – depending on your requirement. AuthBridge’s new-age KYC technology helps businesses enable smart automation and authentication, with minimal manual interventions.

Top three benefits of KYC for verification and onboarding

- Lowers the Risk of Financial Crime: AuthBridge’s industry-leading Digital/Video KYC solutions help prevent financial crime. These solutions use OCR for document digitization, liveness detection, and face match. This helps to verify users with no errors and restricts fraudsters from passing the checks.

- Builds Trust & Transparency With Customers: Any platform brimmed with non-compliant users, criminals, and fraudsters will stop genuine users from using/trading on that platform. AuthBridge’s award-winning KYC technology can help businesses exemplify trustworthiness to new users by tracking mismatches or any discrepancies right at the initial stages of the onboarding process.

- Fastest Turnaround-Time: Manual KYC procedures not only create space for errors but are time-consuming, eventually increasing application dropout rates. AuthBridge’s KYC technology automates KYC verification for faster, fraud-free, and seamless user onboarding. Our KYC solutions reduce operational costs by up to 70% and onboarding time by up to 90% while facilitating frictionless onboarding without compromising accuracy.

At AuthBridge, we are dedicated to offering innovative solutions that leverage the power of AI/ML to simplify the KYC verification process. Our KYC technology uses geo-tagging, OCR, and liveness detection to make the customer onboarding process fast, simple, and stress-free for customers and businesses.