Pre-issuance verification Call (PIVC) represent a cornerstone in India’s insurance sector, primarily serving as a due diligence process to verify customer information before finalizing insurance agreements. This verification step is pivotal in identifying and mitigating risks associated with false claims and information discrepancies, ensuring that only genuine policies are issued. By directly engaging with customers through calls, insurers are able to clarify and confirm the details provided, ensuring the accuracy of critical information which forms the foundation of the insurance contract.

The enhanced customer verification process facilitated by PIVC not only aids in reducing the likelihood of fraud but also significantly improves the quality of customer data. This is crucial for insurance companies as it directly impacts their risk assessment models and policy pricing strategies, leading to more tailored and competitive insurance offerings for the consumer market.

What is a Pre-Issuance Verification Call?

A Pre-Issuance Verification Call (PIVC) is a crucial step in the insurance policy issuance process where the representatives/insurance agent contacts the prospective policyholder to verify the accuracy of information exchanged during the sales process. This call serves as a quality control measure, ensuring that the policy matches the customer’s expectations and needs and that there has been no miscommunication or misunderstanding of the policy terms, benefits, and conditions.

The key objectives of a PIVC include:

- Verifying the information provided by insurance agents or brokers to the customer.

- Ensuring the customer understands and agrees with the policy terms and conditions.

- Confirming the policy aligns with the customer’s insurance needs and expectations.

Why is a Pre-Issuance Verification Call Required?

The necessity of PIVC arises from several critical industry challenges:

- Avoidance of Miscommunication: Misinterpretations or misunderstandings about policy terms can lead to customer dissatisfaction or disputes.

- Prevention of Pressure Selling: It curtails the practice of selling policies through undue pressure, which may not align with the customer’s needs.

- Legal and Compliance Safeguards: PIVC helps in mitigating legal disputes and compliance issues arising from information asymmetry or misrepresentation.

Business implications of lapses in these areas include regulatory fines, loss of customer trust, reputational damage, and increased administrative costs due to disputes—all of which negatively impact the insurer’s bottom line and market standing.

Evolution of PIVC with Technology

The evolution of PIVC in India’s insurance sector has been markedly influenced by advancements in technology. Initially, PIVC processes were largely manual, involving significant human effort and time, which sometimes led to extended turnaround times for policy issuance. However, with the introduction of automated PIVC solutions, there has been a paradigm shift in how customer verifications are conducted.

Technological innovations, such as AI-driven analytics, voice recognition software, and automated dialling systems, have streamlined the PIVC process, making it more efficient and scalable. These tools not only expedite the verification process but also enhance its accuracy by minimizing human error. Moreover, the integration of data analytics enables insurers to glean insights from PIVC interactions, further refining their customer engagement strategies and fraud detection capabilities.

Automated Solutions for PIVC

Leveraging Technology to Streamline PIVC Processes

The advent of automated solutions in the realm of Pre-Issuance Verification Calls (PIVC) has marked a significant milestone in India’s insurance sector, transforming the landscape of customer verification. These technological advancements enable insurers to automate and optimize the PIVC process, reducing manual efforts and improving operational efficiency.

Key technologies driving this transformation include artificial intelligence (AI), machine learning algorithms, and robotic process automation (RPA). AI and machine learning are particularly effective in analyzing customer responses and identifying patterns that may indicate fraudulent activity. RPA, on the other hand, automates repetitive tasks such as dialling numbers and documenting verification outcomes, thereby freeing up human agents to handle more complex cases or exceptions.

These automated solutions are not just about efficiency; they also play a crucial role in enhancing the customer experience. By speeding up the verification process, they reduce the waiting time for policy issuance, thereby meeting customer expectations for swift and hassle-free service. Moreover, automated systems can operate 24/7, providing flexibility for customers to undergo the PIVC process at their convenience.

The Impact of Automation on PIVC Turnaround Time (TAT)

One of the most tangible benefits of introducing automated solutions to the PIVC process is the significant reduction in turnaround time (TAT). Traditional, manually driven PIVC processes could extend the policy issuance timeline, as they were dependent on the availability of human agents and customers to connect over calls. However, with automation, the process has become more streamlined and efficient.

The automation of the PIVC process not only accelerates policy issuance but also enhances the accuracy of customer verifications. By minimizing human intervention, the likelihood of errors is reduced, leading to more reliable and consistent verification outcomes. Additionally, the ability to conduct PIVC at scale means insurers can handle a larger volume of applications without compromising on quality or speed, thereby driving growth and customer satisfaction.

Cost-Benefits of Using a PIVC Solution

- Operational Efficiency and Cost Savings: The adoption of automated PIVC solutions dramatically enhances operational efficiency. By automating the initial stages of customer verification, insurance companies can allocate human resources to more complex tasks, reducing the manpower cost significantly. Moreover, automated solutions minimize the need for repetitive manual calls, directly translating to savings in terms of time and operational expenses. For example, transitioning from manual verification processes, which might cost INR 50 to 100 per call, to automated systems can reduce costs by a substantial margin.

- Improved Turnaround Time (TAT): Automated PIVC solutions can significantly shorten the turnaround time for policy issuance. This efficiency not only improves customer satisfaction by delivering a faster service but also allows insurance companies to handle a larger volume of policies within the same timeframe, potentially increasing revenue.

- Reduction in Fraud and Related Costs: PIVC plays a crucial role in fraud detection by verifying customer information before policy issuance. By identifying fraudulent activities early, insurance companies can avoid the costs associated with processing false claims and the potential legal fees stemming from such disputes.

Impact of Policy Misselling on Brand Reputation

- Eroding Customer Trust: Misselling of insurance policies, where customers are sold policies that do not align with their needs or are misled about policy terms, can severely erode trust in the insurance brand. Once trust is compromised, regaining customer confidence can be a long and challenging process.

- Regulatory Penalties and Legal Repercussions: Misselling not only affects customer relationships but also puts the insurance company at risk of regulatory penalties and legal actions. These can lead to financial losses and damage the brand’s standing in the market.

- Reputational Damage: In the age of social media and online reviews, negative experiences spread quickly. Instances of misselling can damage the reputation of an insurance brand, affecting its ability to attract new customers and retain existing ones.

Utilizing PIVC to Combat Misselling: A robust PIVC process ensures that customers fully understand the policy they are purchasing, including the terms, benefits, and conditions. This direct engagement helps in clarifying any misconceptions and verifying that the policy matches the customer’s needs, significantly reducing the chances of misselling. By prioritizing customer understanding and consent through PIVC, insurance companies can safeguard their reputation and reinforce their commitment to transparency and ethical sales practices.

Building Trust and Transparency with Customers

PIVC plays a pivotal role in building trust and transparency between insurers and customers. By engaging in direct communication, insurers can clarify any doubts or concerns customers may have about the policy or the verification process itself. This open line of communication fosters a sense of trust and reassurance among customers, making them more likely to view the insurer as a reliable and transparent partner.

Moreover, the use of automated solutions in PIVC enhances transparency by providing customers with clear, consistent information and updates throughout the verification process. Customers appreciate the efficiency and professionalism of automated calls, which furthOverview of Successful PIVC Implementations

AuthBridge’s PIVC Solution

The introduction of AuthBridge’s automated PIVC solution has marked a significant evolution in the verification process within the insurance industry. This solution leverages advanced technologies such as

- Artificial Intelligence

- Machine Learning

- automated speech recognition (AI/ML and Speech-to-Text technologies)

to streamline and expedite the verification process, thereby addressing key challenges such as high TAT and operational inefficiencies.

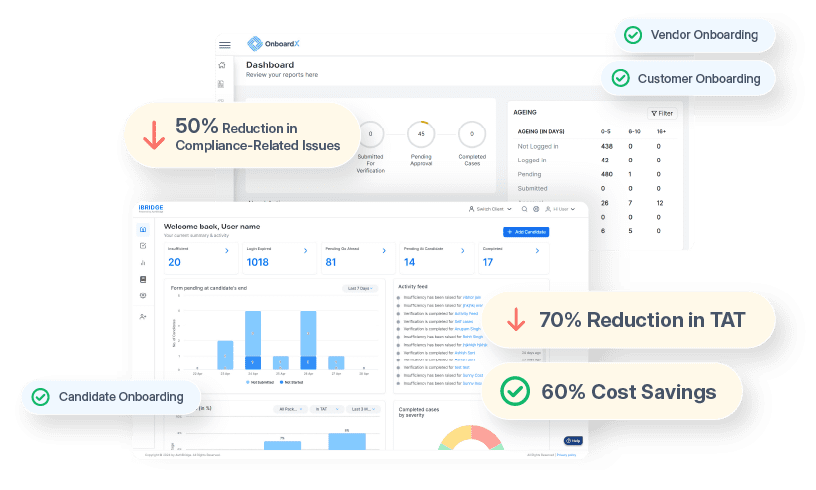

One of the most compelling outcomes of implementing AuthBridge’s automated PIVC solution is the drastic reduction in TAT for policy issuance.

By automating calls and utilizing AI to analyze customer responses, AuthBridge has successfully reduced the PIVC TAT by up to 80%, a milestone that highlights the potential of technology to transform traditional processes. This efficiency not only benefits the insurers by enabling them to serve more customers but also significantly enhances the customer experience by minimizing waiting times.

Furthermore, the accuracy and consistency of verifications have improved, thanks to the minimization of human error. This improvement in data quality and reliability is crucial for insurers, as it directly impacts risk assessment and fraud prevention efforts.

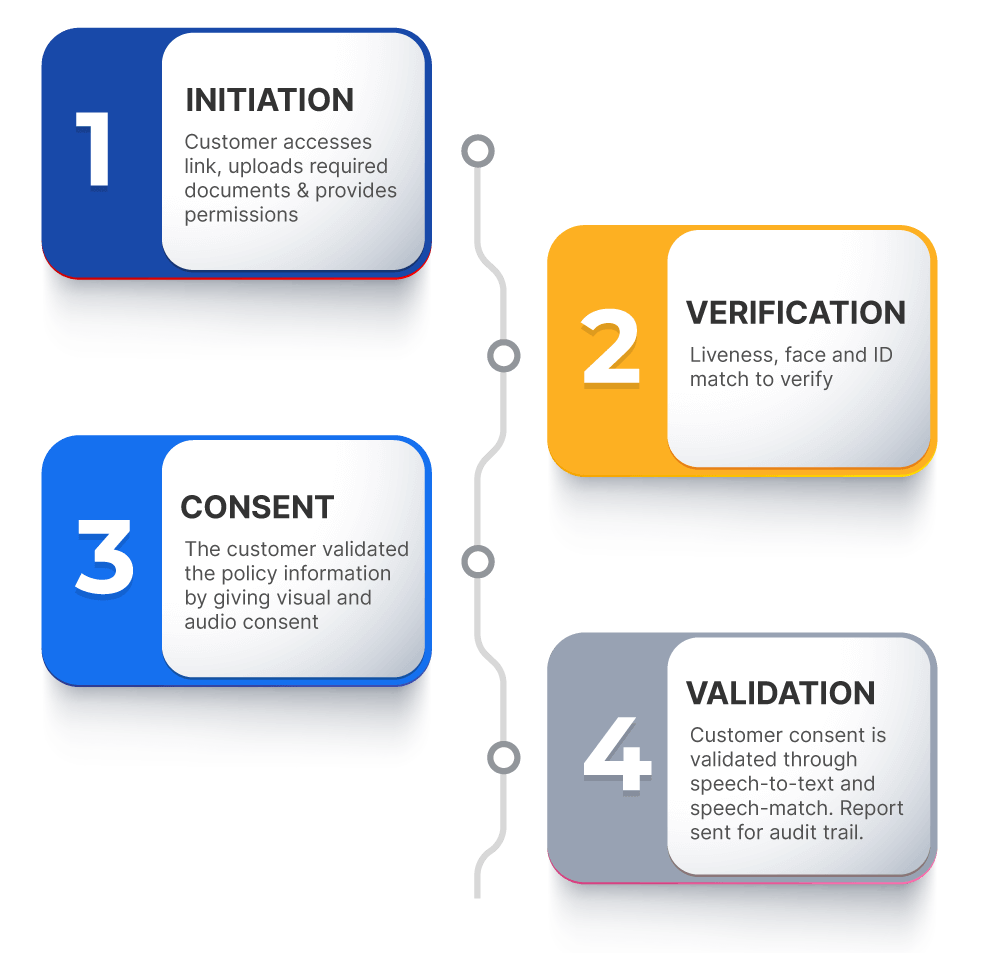

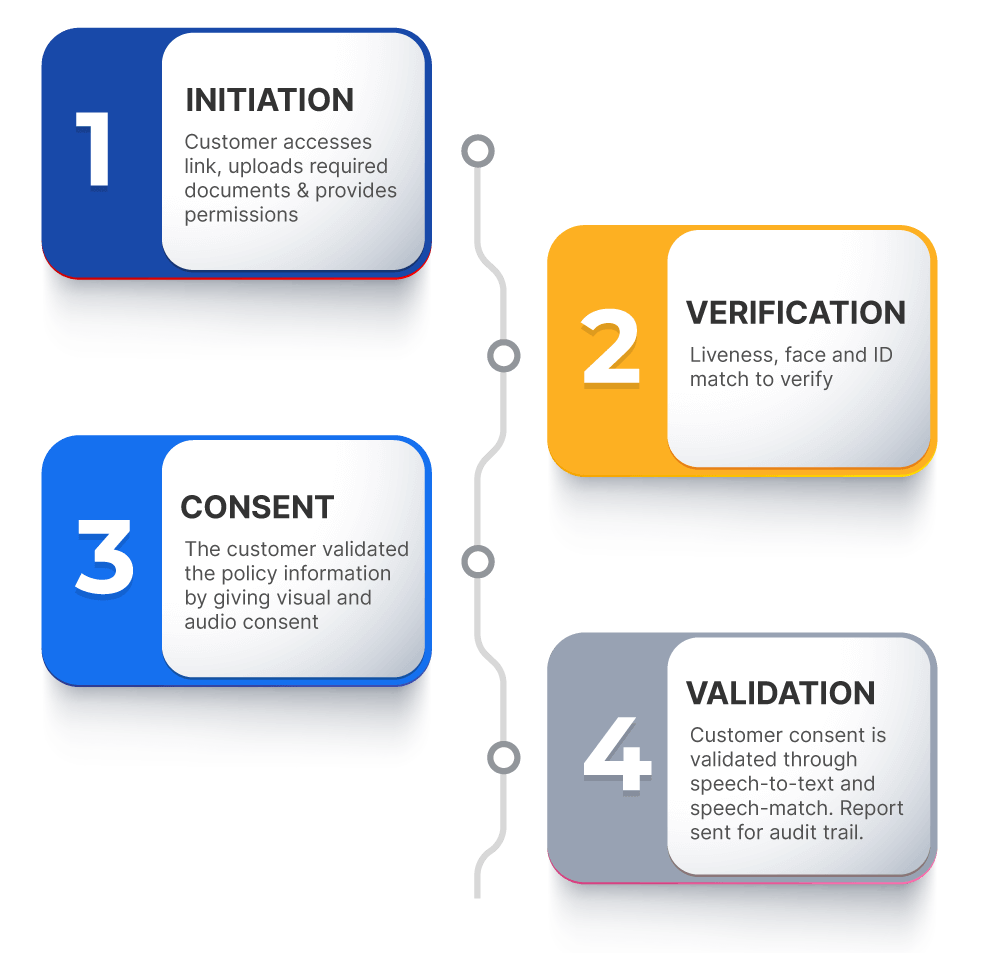

The PIVC solution from AuthBridge, ebodies the following capabilities:

- Customizable Data Collection Journey

- Multi-channel PIVC Initiation

- Real-time Customer Verification

- On-Call Policy Detail Check and Consent Capture

- Customer Consent Validation

Predictions for the Evolution of Verification Processes

The integration of more sophisticated AI and machine learning models will likely make PIVC processes even more efficient and accurate. These technologies will enhance the ability to detect fraud by analyzing voice cues and sentiment, thereby providing an additional layer of security and reliability.

Emerging Technologies and Their Potential Impact

Emerging technologies such as voice biometrics and natural language processing (NLP) are expected to further refine PIVC processes. Voice biometrics, for example, can add a layer of security by verifying the identity of the customer based on their unique voice patterns. Meanwhile, NLP can improve the customer experience by enabling more natural and engaging interactions during the verification call.

As these technologies mature and become more integrated into PIVC solutions, we can expect to see not only improvements in efficiency and security but also a shift towards more customer-centric verification processes. This will likely lead to a significant transformation in how insurance policies are issued and managed, with a focus on convenience, security, and trust.

Business Impact of Automated PIVC:

- Conversion Rates: Initial reach-out success can see improvements, with automated solutions reducing the need for rescheduling.

- Operational Efficiency: With the potential to cut TAT by over 20%, companies can see a direct impact on customer satisfaction and operational cost savings.

- Cost Savings: Transitioning from manual calls to automated solutions can reduce per-call costs significantly, from direct manpower expenses of INR 50 to 100, enhancing profitability.

- Compliance and Legal Security: In light of stringent regulations, the ability to establish secure audit trails with automated PIVC solutions minimizes the risk of hefty fines and legal disputes, safeguarding against liabilities that can arise from mis-selling allegations.

Conclusion

The integration of PIVC in India’s insurance sector highlights the industry’s commitment to leveraging technology to enhance customer verification processes. Automated solutions like AuthBridge’s PIVC solution are leading the way in reducing TAT, improving accuracy, and delivering a better customer experience. As technology continues to evolve, so too will the capabilities and impact of PIVC, promising a future where insurance verifications are more efficient, secure, and customer-friendly.

The future outlook for PIVC technologies is bright, with emerging technologies poised to offer even more significant improvements in the insurance verification process. As these innovations are adopted and integrated, the insurance sector in India and beyond can look forward to enhanced operational efficiency, stronger fraud prevention measures, and an overall improvement in customer satisfaction and trust.