Case Study Download

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Established in October 2016, & headquartered in New Delhi, the client is furnishing its affordable micro-credit services to almost 17.5+ lakh women entrepreneurs from rural and semi-urban areas. The company has experienced substantial growth, reaching an Assets Under Management (AUM) exceeding Rs. 5,000 Cr. It has established a terrestrial presence with over 650 branches spanning 55,000 villages in 25 states.

Finance

5,000-10,000

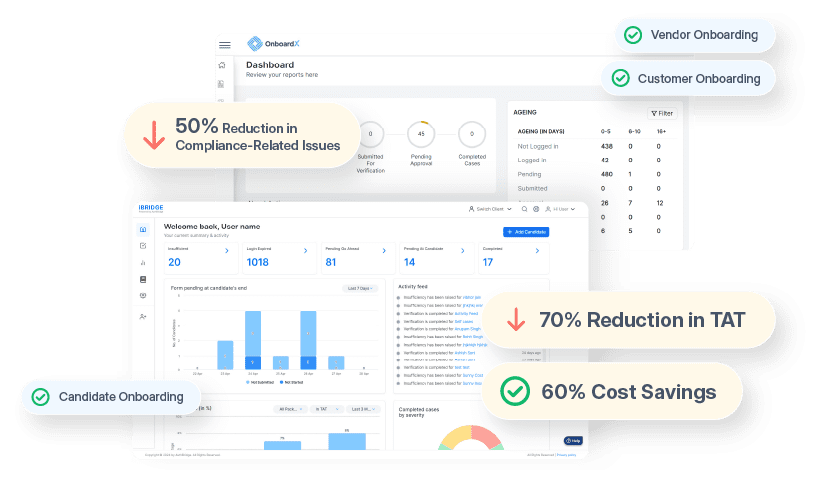

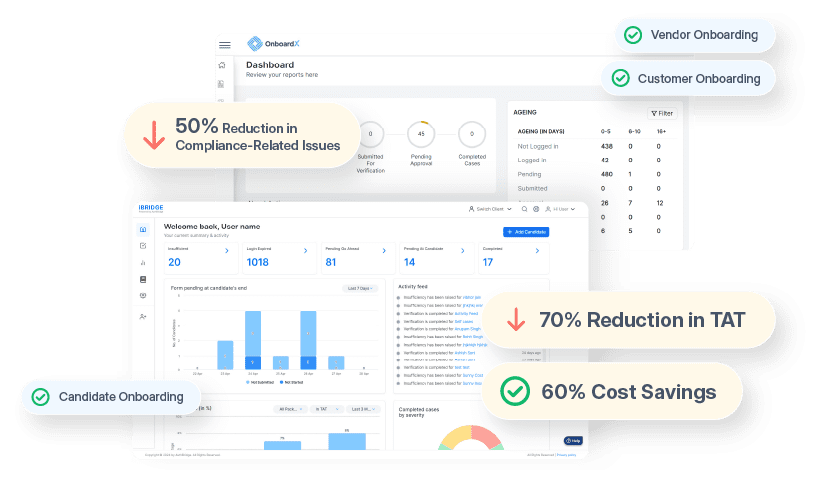

Our customer-centric approach helped our client achieve fantastic results with a heavy drop in TAT as well.

Over 61 million loans are sanctioned through MFIs, emphasizing the immense potential of this use case. AuthBridge’s solution can significantly reduce fraud and improve loan recovery rates for the entire MFI industry.

The client was facing major challenges and issues with repeat borrowers using synthetic/fraudulent identities. This resulted in delinquencies and financial losses.

Looking at the client’s needs and severity of the task at hand, AuthBridge conducted a comprehensive negative photo match exercise for the client’s existing customer base. This helped identify fraudulent borrowers through facial recognition technology.

By transforming fraud check for our client, we empowered the client to focus on what they do best – thriving in their industry, knowing their customer ecosystem is built on trust, efficiency, and cost-effectiveness. Our AI-powered automation boosted speed and scalability and instilled trust, transparency, and compliance.

Share it with someone you might benefit from this. Get your copy today!

By submitting this form you are agreeing to our privacy policy.

Home » Leading Micro Finance Company’s Identity Verification Process Streamlined By AuthBridge

Stay Informed

Keep yourself updated with the latest innovations in BGV & Authentication Technology from India’s leading Background Verification Company

HyperVerge is compliant with international compliance standards & laws

To begin, Tell us a bit about “yourself”

The most noteworthy aspects of our collaboration has been the ability to seamlessly onboard partners from all corners of India, for which our TAT has been reduced from multiple weeks to a few hours now.

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.