We can’t emphasize much on the fact that cryptocurrencies have taken the world by storm and are gearing up to re-envision the conventional mediums of exchange. Crypto is everywhere these days. It’s not just limited to traders, business analysts, or nerds. People are willing to enter the fascinating world of crypto by investing in digital coins and making them a part of their investment portfolio.

Though crypto currency trading is disrupting the financial sector the way one could have never imagined, people are still skeptical of trading coins. Not because the ‘crypto world’ is peppered with friction, but also because it has a history of hacks and scandals.

“With different forms of financial crime such as money laundering, shady transactions, tax evasion surfacing up, crypto exchanges need to deploy strict KYC measures not only to fight financial frauds but also ensure user onboarding at speed and scale.”

Let’s deep dive to understand why cutting-edge KYC technology is imperative for crypto exchanges and trading platforms:

Lowers the Risk of Financial Crime:

2021 has been a record-breaking year in terms of cryptocurrency crime. According to the “2022 Crypto Crime Report” by Chainalysis – blockchain data firm, it is stated that scammers took crypto worth $14 billion last year. It is twice the $7.8 billion taken by scammers in 2020. Take the example of the BITpoint – a Japan’s Cryptocurrency Exchange where $32 million of funds were stolen by the hackers from the hot wallets. Similarly, bitcoins worth $40 million were stolen from Binance.

Weak KYC processes are unable to tap the ill-intentioned users – making the process even more vulnerable. This might also lead to hacks, scams, and phishing. Exchanges should tackle large-scale security breaches and control such instances with strict KYC measures. Leveraging AuthBridge’s industry-leading KYC technology that uses OCR for document digitisation, liveness detection, and face match – lowers financial crime as it verifies users with no errors and roots out scamsters – diminishing illicit activities.

Builds Trust and Transparency With Customers:

Trust and transparency are two prominent factors for cryptocurrencies to reach the level of mass adoption. As the high-tech nature of crypto will continue to attract scammers, KYC becomes crucial to highlight high-risk users and root out criminals. Cryptocurrency exchanges need cutting-edge KYC technology for fraud detection and prevention and for seamless onboarding to keep their users assured about their money security. Any platform brimmed with non-compliant users, criminals, and fraudsters will stop genuine users from trading on that platform. New users feel safe about their money if they know that KYC measures are taken by the platform.

Implementing AI-powered award-winning KYC technology can help exchanges exemplify trustworthiness to new users. KYC and user onboarding technology, which is customizable and integrable, empowers exchanges to root out non-compliant users and spot shady transactions.

Assures Fastest KYC Turnaround-Time:

Manual KYC procedures not only create space for friction and errors but are time-consuming, eventually increasing application dropout rates. Digital KYC ensures frictionless onboarding of the customers – reducing account abandonment rate and drawing more users to the crypto platforms.

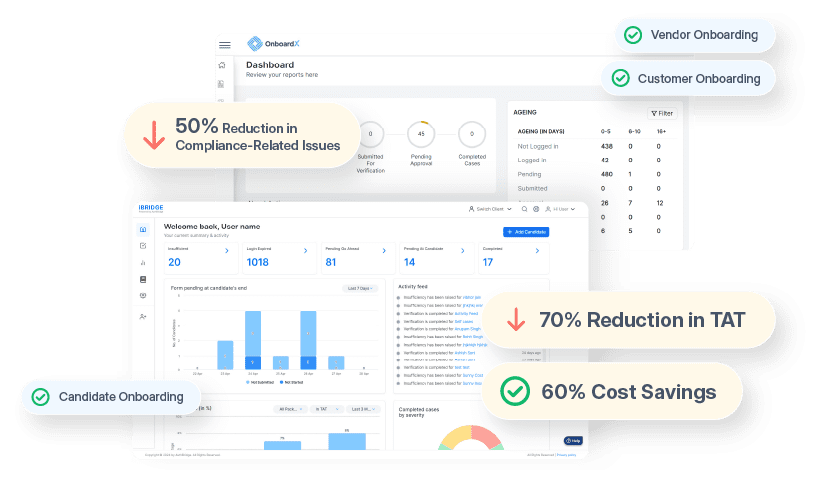

AuthBridge’s KYC technology automates KYC verification for faster, fraud-free, and seamless user onboarding. Solutions like Digital KYC, Video KYC, Digital Address Verification, Bank Accounts Checks, reduce operational costs by up to 70% and onboarding time by up to 90%. Thus, exchanges and trading platforms can eliminate the need for manual authentication and facilitate frictionless onboarding without compromising accuracy of results.

Stabilizes the Crypto Market:

Strict KYC measures and AML compliance can stabilize crypto currency trading and remove the barriers to mass adoption revolving around mistrust. It also helps people to clear their misconceptions associated with the crypto space and see exchanges and trading platforms as legitimate entities. By deploying AI-powered KYC technology, platforms can demonstrate active risk assessment and enable the users to trust the system.

Final Thoughts

Exchanges not only have to keep KYC in place for fraud detection but also have to ensure user boarding onboard 10X faster. AuthBridge’s NASSCOM-recognised KYC technology, powered by AI, solves all these problems by verifying and onboarding users 100% digitally.

It is easily integrable and available as end-to-end onboarding solutions, focused on user experience and scalability.

It’s time to get ready for the future. Contact us to get started!