The Prevention of Money Laundering Act (PMLA) is a comprehensive law that aims to prevent money laundering and terrorist financing in India. The PMLA has been amended several times over the years, and the latest amendments, which came into effect on May 3, 2023, & May 9, 2023, have significant implications for accounting professionals in India.

Under the new amendments, accounting professionals are now considered to be “reporting entities” under the PMLA. This means that they are required to comply with certain AML/CFT requirements, including:

- Identifying and verifying the identity of their clients

- Keeping records of all financial transactions

- Reporting any suspicious transactions to the Financial Intelligence Unit of India (FIU-IND)

The new amendments also clarify which activities carried out by accounting professionals are considered to be “financial transactions” for the purposes of the PMLA. These activities include:

- Managing client money, securities, or other assets

- Managing bank, savings, or securities accounts

- Organizing contributions for the creation, operation, or management of companies

- Creation, operation, or management of companies, limited liability partnerships, or trusts, and buying and selling of business entities

- Buying and selling of any immovable property

- Acting as a trustee, nominee shareholder, director, formation agent, secretary, or partner for a company or LLP

- Providing registered office or business address services

It is important to note that not all transactions performed by accounting professionals will come under PMLA scrutiny. For example, transactions that are carried out as part of any agreement of lease, sub-lease, tenancy, or any other agreement or arrangement for the use of land or building or any space and the consideration is subjected to deduction of income-tax as defined under section 194-I of Income-tax Act, 1961, are not considered to be “financial transactions” for the purposes of the PMLA.

The new AML/CFT requirements for accounting professionals are significant and will have a major impact on the way that they conduct their business. Accounting professionals who fail to comply with these requirements could face significant penalties, including fines of up to ₹1 lakh per transaction.

What does the notification mean for accounting professionals?

The new AML/CFT requirements for accounting professionals will have a significant impact on the way that they conduct their business. Accounting professionals will now need to take steps to identify and verify the identity of their clients, keep records of all financial transactions, and report any suspicious transactions to the FIU-IND. Failure to comply with these requirements could result in significant penalties, including fines of up to ₹1 lakh for each failure.

What can accounting professionals do to comply with the new AML/CFT requirements?

There are a number of things that accounting professionals can do to comply with the new AML/CFT requirements. These include:

- Implementing a customer due diligence (CDD) process to identify and verify the identity of their clients including but not limited to PEP, Sanctions, Criminal, Defaulting Directors and Companies, Credit Default checks

- Keeping records of all financial transactions

- Reporting any suspicious transactions to the FIU-IND

- Training their staff on the new AML/CFT requirements

What are the benefits of complying with the new AML/CFT requirements?

There are a number of benefits to complying with the new AML/CFT requirements. These include:

- Reducing the risk of being involved in money laundering or terrorist financing

- Protecting the reputation of your business

- Avoiding fines and penalties

How can AuthBridge help?

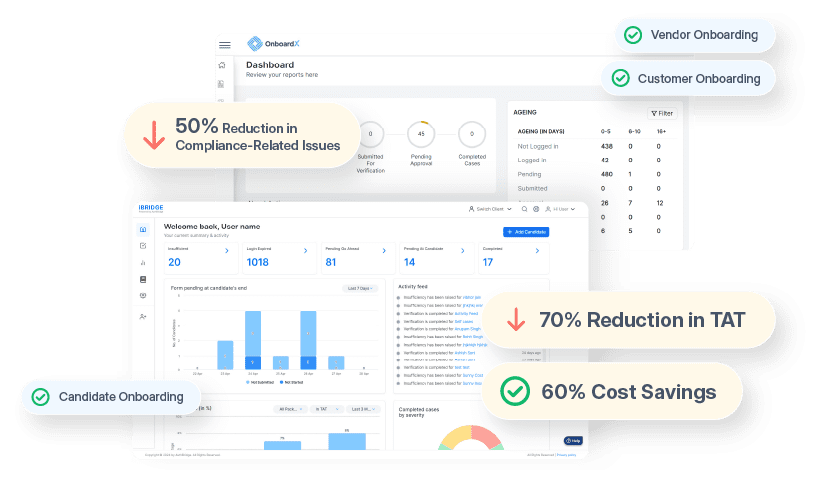

AuthBridge is a leading provider of AML/CFT compliance solutions. We can help you understand the new AML/CFT requirements and implement the necessary controls to ensure that you are compliant. Our solutions are easy to use and can be customized to meet the specific needs of your business.

To learn more about how AuthBridge can help you comply with the new AML/CFT requirements, please get in touch with us today.