An increasing number of frauds committed by a company’s own employees have led to the need for more stringent background verification.

How employees have defrauded their companies

In June 2017, 53-year-old Susan Rue pleaded guilty to defrauding her former employers Procter and Gamble of $500,000. In her fourteen years with the company, Rue would often receive checks for official expenses which she would use to pay off her personal bills. Philadelphia-based Wells Fargo employee Hassante Denise East was arrested last year on charges of fraud and identity theft. East had repeatedly withdrawn money using fraudulent checks in fifty-four of the company’s bank accounts. Former J. P. Morgan and Chase employee Lawrence Obracanik wire transferred $5 million of company funds to his personal account fraudulently. Obracanik who had a gambling problem used the stolen funds to pay off his personal debt.

Background screening

With employees having access to a company’s bank accounts, cheque books, passwords and other sensitive information, background check are extremely important. Because of the growing number of frauds being inside jobs, the onus falls on the employer to ensure that they are hiring the right kind of person. Following a comprehensive checklist and knowing what to look for during a background check could save employers a lot of trouble, embarrassment and money in the long run.

Here are a few things you should look for before you hire someone:

1. Criminal records: The first thing you need to be sure about is that the potential employee does not have a criminal record that has not been disclosed. A criminal record that has been kept under wraps should be handled with caution.

2. Credit check: Credit checks of employees are especially important for banks and other financial institutions. If you are going to entrust an employee with large sums of clients’ money, you need to be sure that they have been able to manage their own cash well. Applicants with bad credit scores and who are constantly in debt don’t make good candidates.

3. The authenticity of information on biodata: Verification of educational qualifications and past work experience is a must for two reasons- to make sure the applicant is being honest and that he or she does, in fact, have the required skills. False information on a CV is a big red flag that employers should not ignore. By taking these three points into consideration, employers can ensure that the people they are hiring are skilled, reliable and honest and forthcoming with their information. Anyone who falls short of these given criteria could prove to be a liability to the company.

Also read: 7 Ways of Preventing Fraud: Your Essential ‘Check’ List

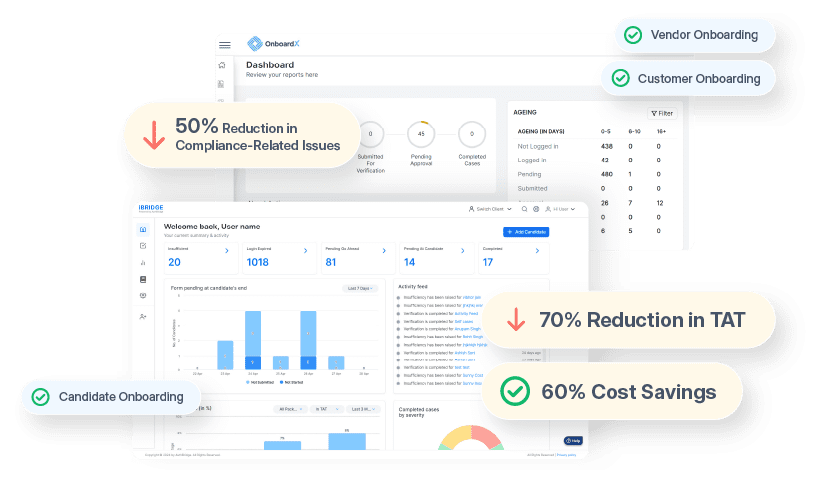

API integration and expediting background checks

To manually do a background check on every applicant could be a long and tedious process. Manual checks could also overlook information that might have been important to the cause. A process to speed up background verification is required for the more efficient running of the company. Integrating an Application Performance Interface (API) for background verification could solve the problems that arise with manual checks. The API would serve to capture candidates’ information and their consent and automatically run a verification check.

The Automated system would immensely speed up the process and eliminate a lot of the human error. The interview and hiring process would be helped along more efficiently with the integration of an API into a company’s systems. A person who is not averse to falsifying claims on their CV cannot be trusted to maintain the integrity of a company. Undisclosed past criminal records, bad credit and false representation of qualifications can all be verified by doing a background check and help eliminate undeserving candidates.