The financial technology (Fintech) sector is brimming with innovation, transforming how we access and manage our finances. From mobile payments and peer-to-peer lending platforms to robo-advisors and blockchain-powered solutions, Fintech disrupts traditional financial services by offering faster, more convenient, and often more affordable options. However, this rapid innovation presents a unique challenge: keeping pace with a complex and ever-evolving regulatory landscape.

Financial regulations are crucial for protecting consumers, ensuring financial stability, and preventing fraud. However, for Fintech companies, navigating these intricacies of rules and regulations can be a significant hurdle to overcome. Complying with Know Your Customer (KYC), Anti-Money Laundering (AML), and other regulations often involves manual tasks, extensive paperwork, and resource-intensive processes.

The sheer volume of regulations combined with their frequent updates can overwhelm even established Fintech companies. This burden can stifle innovation and hinder the growth of the entire sector.

Introduction To RegTech

RegTech (regulatory technology) is a rapidly growing sub-sector of Fintech that leverages cutting-edge technologies to help financial institutions comply with regulations and manage risk more effectively. By harnessing automation, data analytics, and artificial intelligence (AI), RegTech solutions offer a streamlined and efficient approach to navigating the complexities of financial regulation.

Streamlining Compliance With RegTech Solutions

The ever-growing compliance burden on Fintech can be significantly alleviated by implementing RegTech solutions. These innovative tools empower Fintech companies to automate manual tasks, simplify KYC/AML processes, and enhance regulatory reporting efficiency. Let’s delve deeper into how RegTech streamlines compliance for Fintech businesses.

Automating Manual Tasks and Reporting

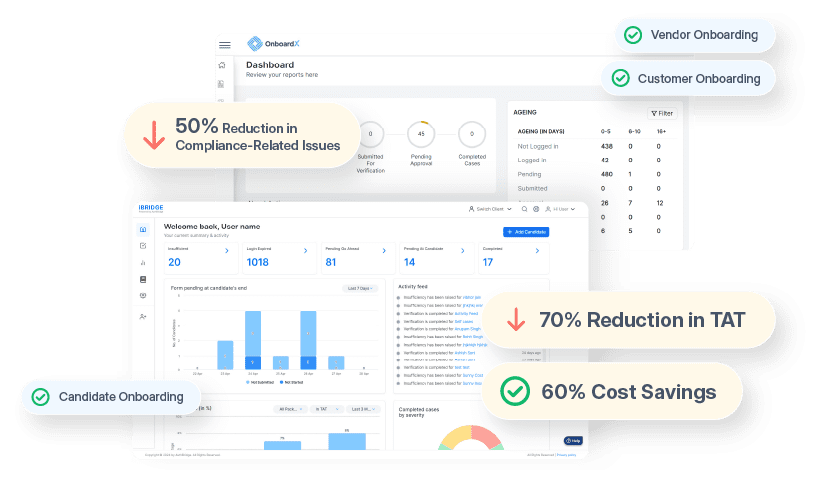

A significant portion of compliance efforts in Fintech involves repetitive, manual tasks such as data entry, customer onboarding, and report generation. RegTech solutions automate these tasks using Robotic Process Automation (RPA) and machine learning algorithms. This frees up valuable time and resources for Fintech companies, allowing them to focus on core business activities and innovation.

For instance, RegTech platforms can automate the extraction of customer data from various sources during onboarding, streamlining KYC verification. Additionally, AI-powered solutions can analyze vast amounts of transactional data to identify potential anomalies and generate regulatory reports automatically, saving countless hours previously spent on manual data analysis and report preparation.

KYC/AML (Know Your Customer/Anti-Money Laundering) Simplification

KYC and AML compliance are essential for Fintech companies to prevent financial crime and protect consumers. However, traditional KYC/AML processes are often cumbersome and time-consuming. RegTech solutions offer innovative approaches to simplify these processes while maintaining compliance.

One way RegTech simplifies KYC/AML is through identity verification tools. These tools leverage facial recognition, document verification, and other biometric technologies to verify customer identities quickly and accurately. Additionally, RegTech platforms can automate customer risk assessments based on real-time data analysis, enabling a more targeted approach to AML compliance.

For example, a RegTech solution might analyze a customer’s transaction history, geographical location, and source of funds to assess their risk profile. This allows the Fintech company to focus their AML efforts on high-risk customers, improving overall compliance efficiency.

Regulatory Change Management And Reporting Efficiency

The regulatory landscape for Fintech is constantly evolving, with new rules and updates emerging frequently. Keeping track of these changes and ensuring compliance can be a significant challenge. RegTech solutions provide valuable tools for regulatory change management and reporting efficiency.

RegTech platforms can monitor regulatory changes in real-time, alerting Fintech companies to updates that might impact their operations. Additionally, these platforms can help automate the process of adapting internal policies and procedures to comply with new regulations. This proactive approach minimizes the risk of non-compliance and ensures Fintech companies remain adaptable in a dynamic regulatory environment.

Furthermore, RegTech solutions can streamline regulatory reporting by integrating with existing systems and automating data collection. This reduces the burden of manual data gathering and report preparation, ensuring timely and accurate submission of regulatory reports to the authorities.

RegTech platforms can monitor regulatory updates, industry trends, and legislative proposals. These automated systems can flag relevant changes and provide summaries for further analysis by your compliance team. This empowers Fintech firms to stay ahead of the curve and adapt their processes proactively.

Mitigating Risks with RegTech: A Proactive Approach

The financial services industry is inherently risk-prone, and Fintech companies are no exception. Cybersecurity threats, fraud attempts, and evolving regulatory landscapes all pose significant risks to Fintech businesses. Fortunately, RegTech offers a powerful toolkit to mitigate these risks and foster a more secure and stable financial ecosystem. Here’s how RegTech empowers Fintech companies to proactively manage risk.

Fraud Detection and Prevention through Advanced Analytics

Fraudulent activities remain a persistent threat in the financial sector, and Fintech companies are particularly vulnerable due to their reliance on digital transactions. RegTech solutions equip these companies with advanced fraud detection and prevention capabilities.

These solutions leverage machine learning algorithms to analyze customer behaviour patterns and identify anomalies that might signify fraudulent activity. Real-time transaction monitoring allows RegTech platforms to detect suspicious patterns and flag potential fraud attempts before they occur. Additionally, AI-powered tools can be used to analyze vast datasets and identify emerging fraud trends, enabling Fintech companies to stay ahead of evolving threats.

For example, a RegTech platform might analyze a customer’s past transactions, location data, and spending habits to create a baseline behaviour profile. Any significant deviations from this baseline, such as a sudden spike in transaction volume or a location mismatch during a purchase, could trigger a fraud alert for further investigation.

By proactively identifying and preventing fraud attempts, RegTech solutions help Fintech companies minimize financial losses and maintain customer trust.

Cybersecurity Fortification with RegTech Tools

In the fast-paced world of Fintech, staying ahead of the curve is crucial. Regulatory landscapes are constantly evolving, and new regulations can have a significant impact on your business operations. This is where RegTech shines – it empowers Fintech firms to not only comply with existing regulations but also proactively assess and manage potential risks associated with future regulatory changes.

What is Regulatory Risk Assessment?

Regulatory risk assessment involves identifying, analyzing, and evaluating the potential impact of regulatory changes on your Fintech business. This proactive approach allows you to:

- Gain Early Insights: By leveraging RegTech solutions, you can analyze regulatory proposals, industry trends, and legislative updates. This provides valuable insights into potential changes that might affect your business model, products, or services.

- Identify Potential Compliance Gaps: Regulatory risk assessment helps you identify areas where your current processes or procedures might not comply with upcoming regulations. This allows you to take proactive steps to close these gaps before they become compliance issues.

- Prioritize Resources: Not all regulatory changes will have the same impact on your business. RegTech empowers you to prioritize resources by assessing the likelihood and potential severity of various regulatory risks.

How Can RegTech Facilitate Regulatory Risk Assessment?

RegTech solutions offer a variety of tools and functionalities for comprehensive regulatory risk assessment:

- Regulatory Change Tracking: RegTech platforms can monitor regulatory updates, legislative proposals, and industry publications. These automated systems can flag relevant changes and provide summaries for further analysis by your compliance team.

- Impact Analysis Tools: RegTech solutions can analyze the potential impact of regulatory changes on your business. These tools can consider factors such as your current compliance processes, technology infrastructure, and product offerings.

- Scenario Planning and Simulations: RegTech allows you to run simulations based on different regulatory scenarios. This allows you to test the effectiveness of your existing compliance framework and identify areas that might require adjustments.

Benefits of Proactive Regulatory Risk Assessment

By proactively assessing regulatory risks, Fintech firms can gain a significant competitive advantage:

- Enhanced Agility and Adaptability: Early identification of potential regulatory changes allows for timely adjustments to business strategies and processes, ensuring continued compliance and smooth operations.

- Reduced Compliance Costs: Proactive efforts to address potential compliance gaps early on can minimize the need for costly last-minute adjustments or potential fines.

- Improved Risk Management: Understanding potential regulatory risks enables a more comprehensive risk management strategy, promoting financial stability and operational resilience.

The Power of Scenario Planning

Scenario planning is a crucial element of proactive risk management. RegTech facilitates this process by allowing you to model different regulatory scenarios and assess their potential impact on your business. This empowers you to:

- Develop Contingency Plans: By anticipating potential regulatory changes, you can develop contingency plans to mitigate their impact. This could involve developing new technology solutions, adjusting product offerings, or revising internal policies and procedures.

- Stress Test Your Compliance Framework: Scenario planning allows you to test the effectiveness of your existing compliance framework under simulated regulatory pressure. This identifies weaknesses and allows for proactive reinforcement.

- Promote a Culture of Compliance: Proactive risk management fosters a culture of compliance within your organization. Employees become aware of potential risks and understand the importance of adapting to changing regulations.

RegTech’s ability to facilitate regulatory risk assessment and scenario planning empowers Fintech firms to move beyond simple compliance and embrace a proactive approach to risk management. By anticipating future regulatory changes, Fintech companies can ensure operational resilience, mitigate potential disruptions, and seize opportunities for continued growth within the ever-evolving regulatory landscape.

About AuthBridge

With over 18 years of experience in the industry, AuthBridge has been at the forefront of creating databases, conducting data mining and live scraping of data, and building algorithms to enable instant searches to perform background checks without compromising on data security. AuthBridge is trusted by over 2,000 clients in 140 countries for their background check needs. Our database contains over 1 billion proprietary data records for conducting background checks. AuthBridge conducts an impressive volume of 15 million background checks every month.