Introduction

In an increasingly interconnected business environment, Indian companies are extensively engaging with third parties to drive growth, access new markets, and enhance service offerings. This extensive network, while beneficial, exposes organizations to various risks including operational, reputational, compliance, and cybersecurity threats. Given the complex regulatory landscape in India, marked by stringent guidelines across sectors, and the evolving global threats, implementing a robust Third-Party Risk Management (TPRM) framework has become imperative for safeguarding assets and maintaining competitive edge.

Understanding the Framework

A Third-Party Risk Management Framework is a structured approach to identifying, assessing, managing, and monitoring the risks associated with external business relationships. This framework is essential for ensuring that third-party engagements are in line with an organization’s risk appetite and compliance requirements. For Indian businesses, the framework not only supports compliance with local regulations but also facilitates adherence to international standards, enhancing global business operations.

Developing a TPRM Framework

Identifying Key Components

The development of a TPRM framework begins with identifying its key components, which include governance, risk assessment, due diligence, contract management, ongoing monitoring, and incident response. Each component plays a crucial role in creating a comprehensive approach to third-party risk management.

Establishing Governance Structures

A well-defined governance structure is the backbone of an effective TPRM framework. It involves setting up a dedicated team or office responsible for third-party risk management, defining roles and responsibilities, and establishing reporting lines. This governance structure ensures accountability and facilitates the strategic alignment of TPRM activities with the overall business objectives.

Key Components of an Effective TPRM Framework

Risk Identification and Categorization

A fundamental step in TPRM is identifying the types of risks third parties might introduce to the organization. This includes financial, operational, reputational, cyber, and compliance risks. In India, where regulatory and compliance risks are particularly high due to the complex legal environment, categorizing risks based on their nature and potential impact is crucial. This process helps in prioritizing risk management efforts and resources effectively.

Due Diligence and Third-Party Selection

Conducting thorough due diligence before engaging with a third party is critical. For Indian companies, this involves verifying the third party’s compliance with local regulations, assessing their financial stability, and evaluating their cybersecurity measures. The goal is to ensure that the third party aligns with the organization’s standards and regulatory requirements, minimizing potential risks.

Contract Management

Effective contract management is essential for delineating the expectations, responsibilities, and liabilities of both parties. Contracts with third parties in India should include clauses related to compliance with local laws, data protection, confidentiality, and audit rights. This ensures that any engagement is legally sound and provides mechanisms for recourse in the event of a breach.

Ongoing Monitoring and Risk Management

Ongoing monitoring of third-party relationships is essential to detect and address risks proactively. This includes regular reviews of the third party’s performance, compliance audits, and monitoring for any changes in the third party’s business environment that might affect risk levels. Leveraging technology for continuous monitoring can significantly enhance this process’s efficiency.

Incident Management and Contingency Planning

Having a clear incident management and contingency planning process in place is crucial for minimizing the impact of any third-party failures. This involves establishing communication protocols, response procedures, and recovery plans. For Indian businesses, where the impact of such incidents can extend to severe regulatory penalties, this component of the TPRM framework cannot be overlooked.

Regulatory Compliance and Standards in India

Overview of Indian Regulatory Landscape

India’s regulatory environment is characterized by a variety of sector-specific and general regulations that govern third-party engagements. From the Reserve Bank of India (RBI) guidelines for the financial sector to the Information Technology Act for data protection, understanding these regulations is crucial for effective TPRM.

Aligning TPRM with Indian Regulations

Aligning the TPRM framework with Indian regulations involves ensuring that all third-party engagements comply with relevant laws and standards. This includes implementing processes for regular compliance assessments, staying updated with regulatory changes, and integrating legal requirements into all TPRM activities. Collaboration with legal experts and regulatory advisors is often beneficial in navigating this complex landscape.

By meticulously addressing each component of the TPRM framework and ensuring alignment with India’s regulatory standards, businesses can establish a robust foundation for managing third-party risks. The implementation of this framework not only safeguards against potential threats but also enhances operational resilience and compliance, positioning Indian businesses for success in the competitive global marketplace.

Implementing the TPRM Framework

Step-by-Step Implementation Guide

Implementing a TPRM framework involves several key steps, each crucial for ensuring the framework’s effectiveness in identifying, managing, and mitigating third-party risks.

- Initial Assessment: Begin with a thorough assessment of the current state of third-party engagements and existing risk management practices. This helps in identifying gaps and areas for improvement.

- Framework Design: Based on the initial assessment, design a TPRM framework that aligns with the organization’s risk appetite, regulatory requirements, and business objectives. Ensure it covers all key components previously discussed.

- Technology Integration: Leverage technology and tools that facilitate the automation of risk assessments, due diligence processes, and continuous monitoring of third-party engagements. Select solutions that offer scalability and integration capabilities with existing systems.

- Stakeholder Engagement: Engage with key stakeholders across the organization to ensure alignment and buy-in. Effective communication and collaboration are crucial for the successful implementation and adoption of the TPRM framework.

- Training and Awareness: Develop comprehensive training programs to ensure that employees understand their roles within the TPRM framework. Regular awareness sessions can help in keeping the risks associated with third-party engagements at the forefront of organizational priorities.

- Continuous Improvement: Implement a process for regular review and refinement of the TPRM framework. This should include feedback mechanisms to capture lessons learned and adapt to evolving risk landscapes and regulatory changes.

Challenges and Best Practices

Common Implementation Challenges

Implementing a TPRM framework can present several challenges, particularly in a complex regulatory and business environment like India’s. These may include:

- Data Management Difficulties: Managing and analyzing large volumes of data related to third-party engagements can be overwhelming.

- Integration with Existing Systems: Seamlessly integrating TPRM tools with existing enterprise systems can pose technical challenges.

- Stakeholder Resistance: Resistance from internal stakeholders due to perceived increases in workload or changes in existing processes.

Best Practices for Indian Businesses

To navigate these challenges effectively, consider the following best practices:

- Prioritize Data Quality: Ensure that the data used for risk assessments and monitoring is accurate and up-to-date. Investing in data management solutions can facilitate this.

- Choose Flexible Technology Solutions: Opt for TPRM tools that offer flexibility and can be easily integrated with a wide range of systems and platforms.

- Foster a Risk-aware Culture: Build a culture that emphasizes the importance of risk management. Regular training and communication can help in aligning stakeholder perceptions and objectives with the TPRM framework.

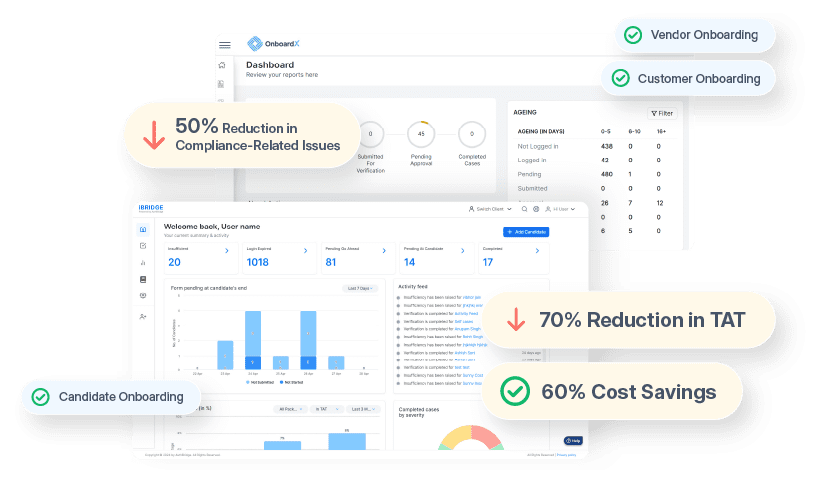

OnboardX By AuthBridge

Welcome to the Future of Vendor Management, OnboardX: The Comprehensive Platform for end-to-end Third-Party Onboarding and Verification. Say goodbye to the hurdles of inefficiency, data disparities, and regulatory complexities.

Adopt a path of automated processes, scalable operations, and cutting-edge analytics to elevate your vendor relationship management to new heights.

As leaders in the world of BGV and due-diligence, our one stop onboarding solution aims to provide seamless onboarding to organisations by offering features such as:

- Case approval workflow with payment and contract signing

- Custom communication options in emails and WhatsApp

- 160+ real-time checks and verifications

- Personalized and customizable solution

- Seamless API integration

- Fully automated journey with multiple touch points and clear visibility

Conclusion

The strategic implementation of a TPRM framework is crucial for Indian businesses navigating the complexities of third-party engagements in today’s interconnected world. By addressing the key components of the framework, overcoming implementation challenges through best practices, and learning from real-world examples, organizations can significantly mitigate risks associated with third-party relationships. As businesses continue to evolve, so too will the approaches to managing third-party risks, underscoring the need for ongoing vigilance, adaptation, and improvement in TPRM practices.