Step into the realm of authentication innovation with AuthBridge as we unveil our latest product developments. We’re excited to introduce you to the future of authentication, where efficiency meets security and user experience is paramount.

In this blog, we’ll take you on a journey through the newest features and enhancements across our authentication product suite. From streamlining onboarding processes and enhancing client support to revolutionizing document management and advancing identity verification, each innovation is meticulously designed to redefine industry standards and empower our clients for success.

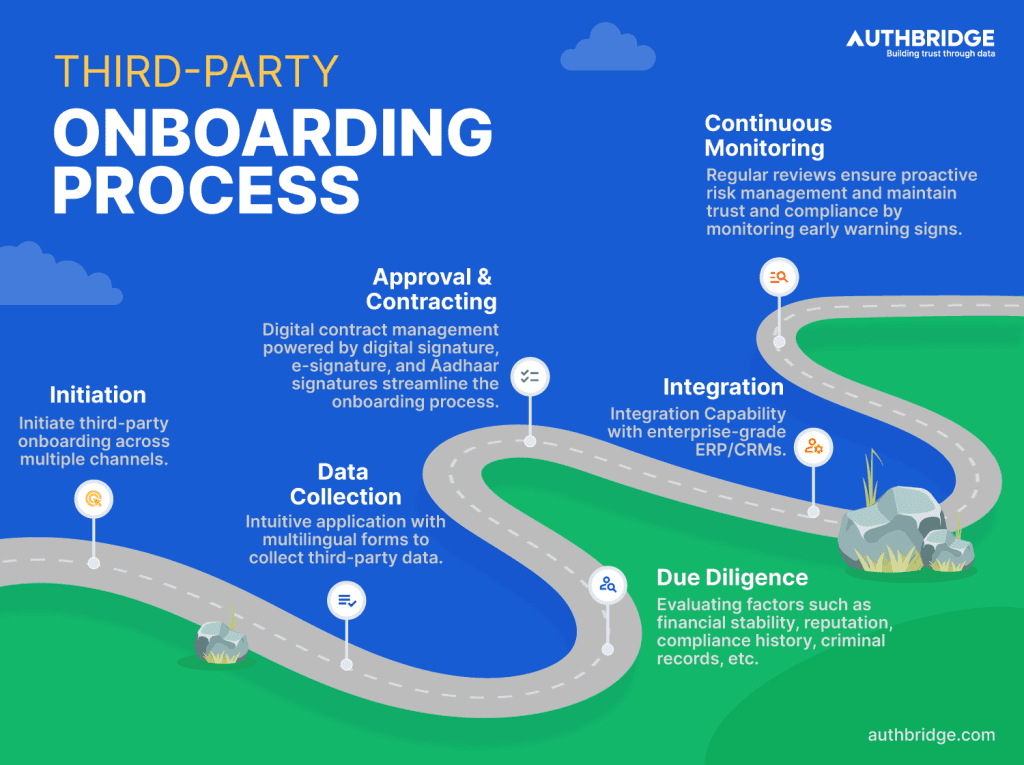

- Multi-lingual Forms for faster Third-party and Gig worker Onboarding: Conduct tests for your drivers and gig workers on our platform in multiple languages, such as English, Hindi, and Kannada. Our AI-powered onboarding software, OboardX, now offers multilingual support to cater to diverse linguistic preferences. Test forms are available in Kannada, Hindi, and English, with plans to include more languages. This update particularly benefits businesses with a significant blue-collar workforce, ensuring a seamless onboarding experience across various geographies and backgrounds.

- Customisable Onboarding Journeys: Businesses can now customise their onboarding journeys based on geographical locations, entity types, and regional requirements. This will benefit businesses with a presence across multiple countries or states and may need to comply with different regulations and documentation processes in each location. For instance, in India, there may be a requirement to submit documents different from those in the United States, and the latest updates in OboardX can adapt to accommodate these variations seamlessly. This feature allows for the adaptation of documentation processes to comply with country-specific regulations, enhancing efficiency and compliance.

- Chatbot based Customer Support: Get easy access to FAQs and helpful articles on the iBridge’s interface. Receive real-time assistance and guidance, improving their understanding of and use of our products.

- End-to-end Ticket Management: Create, track, and resolve support tickets directly through the iBridge platform, eliminating the need for separate portals like Freshdesk. Instead of navigating to a different support platform, clients can log into iBridge and manage a ticket directly within the same interface. This centralised approach enhances efficiency and simplifies the ticket resolution process.

- Improved Invoicing for Postpaid Clients: With in-platform invoicing on iBridge, accessing invoices and related documents is now more convenient for postpaid clients. Previously, clients had to rely on email to receive invoices and related documents each month, requiring manual intervention. With this latest update, clients can now conveniently access and download invoices and annexures directly from iBridge. This enhancement offers clients greater autonomy and efficiency in managing their billing processes by eliminating the need for manual intervention and reducing dependency on account managers.

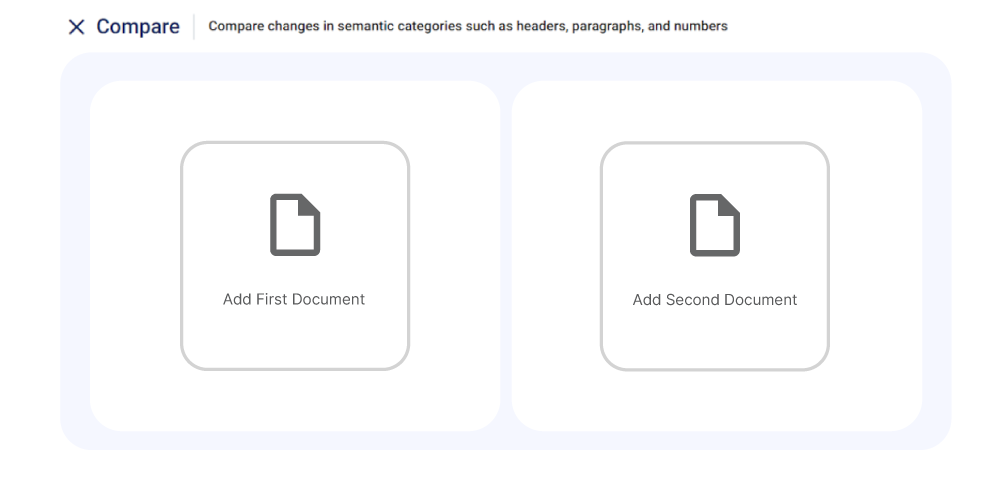

- Compare Documents on the GO: This latest product update for SignDrive will enable the clients to compare documents on the go. Now, clients can easily track any changes made to a document after it has been signed by uploading and comparing both the post-signing and signing documents. This feature empowers clients to ensure the integrity and accuracy of their documents, providing them with greater confidence in their agreements and transactions. Whether it’s verifying contract modifications, detecting unauthorised changes, or simply confirming document authenticity, the ability to compare documents seamlessly enhances the overall document management process for our clients.

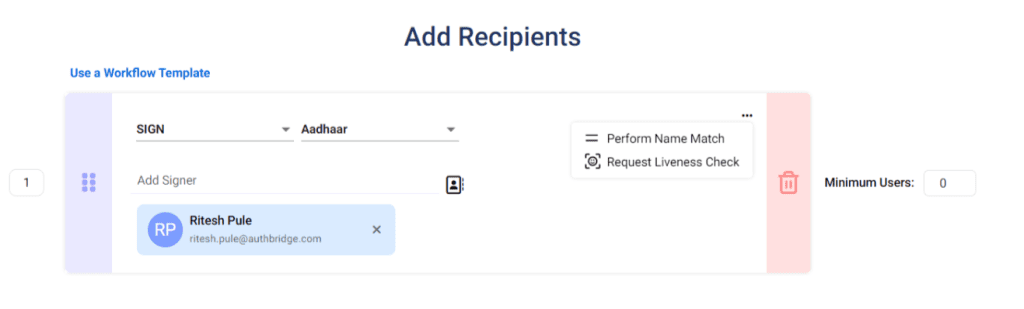

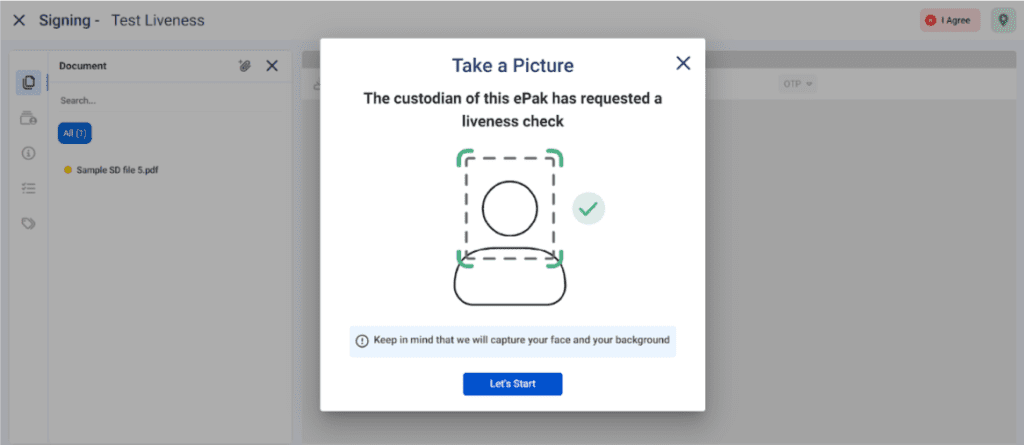

- Name Match and Liveness check for Aadhaar

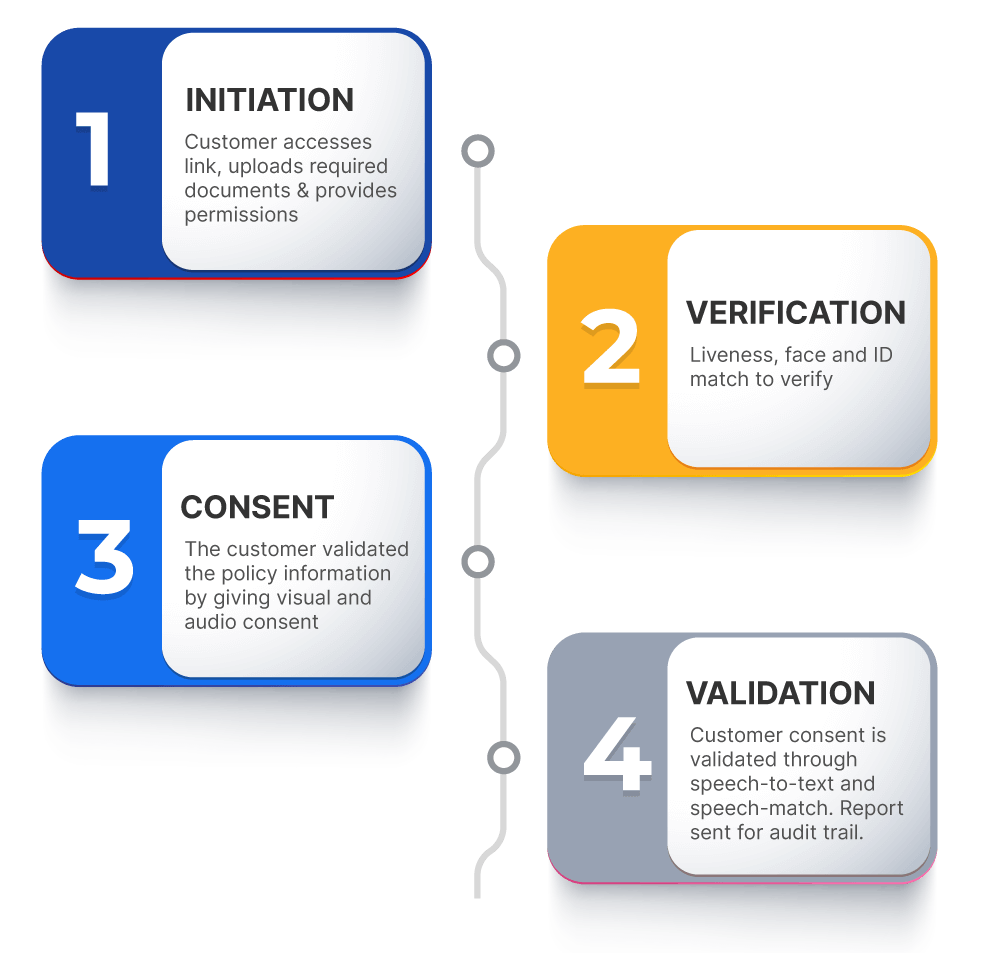

Aadhaar Name Match: Now, clients can confirm whether the assigned signer uses their own Aadhaar details to sign the document. By matching the name on the Aadhaar card, this latest update will prevent non-signers from using unauthorised Aadhaar cards to sign documents. This robust identity verification process adds an extra layer of security, safeguarding against fraudulent activities and unauthorised access to sensitive documents.

Liveness Feature: The liveness detection feature enhances identity verification by capturing a picture of the signer while they are signing the document. This will ensure the signer is physically present and actively participating in the signing process, preventing impersonation and unauthorised access. Clients can rest assured that only authorised individuals are signing documents, mitigating the risk of fraud and ensuring compliance with regulations.

- Bulk Compose with Bulk Stamp: Now, clients can send documents to multiple signers in one go with stamp papers as part of the agreements/affidavits/deeds, etc. This capability simplifies managing and executing bulk agreements, saving clients time and effort.

- Geo Location in the audit trail: This feature provides clients with enhanced transparency and compliance by capturing the geolocation of signers in the audit trail. Now, clients can track the physical location of signers when they electronically sign documents, adding an extra layer of security and accountability to the signing process. Whether ensuring that agreements are signed within authorised jurisdictions or verifying the authenticity of signatures, the Geo Location feature offers clients valuable insights for compliance purposes.

- GST Advanced Version 2: With this update, clients can conduct detailed GST verification, including HSN, branch, and filing details. Additionally, clients can now verify anything against GST, such as office location or branch location. This comprehensive verification capability enables clients to ensure accuracy and compliance in their GST-related processes, enhancing efficiency and reducing risks associated with incorrect or incomplete information.

- Salary Slip OCR: Our AI and ML-trained model enable clients to extract details from salary slips quickly and accurately. By automating the extraction of details from salary slips, clients can save time and resources while maintaining accuracy and reliability in their salary-related information verification.

- PAN Verification API: Multiple advancements have been made in the PAN verification API, including the ability to verify whether the entered PAN and Aadhaar numbers are linked together. With PAN Aadhaar seeding, clients can process large sets of data in a short time, ensuring faster processing and a 99.9% success rate.

- Fetch UAN Details Against Aadhaar: This feature allows clients to fetch details of the UAN number registered against the Aadhaar Number. This capability simplifies retrieving UAN-related information, enabling clients to access essential details quickly and efficiently. By facilitating Aadhaar to UAN linkage, this feature enhances the convenience and accessibility of UAN-related services for clients.