Ever experienced difficulties evaluating an onboarding solution for individuals, agencies, or third-party businesses? Do they all look the same, making it difficult for you to identify the best? If the answer to all the questions is yes, you have landed in the right place.

We have collated a step by step guide and a checklist to help you choose the best onboarding solution for your business.

Before making a purchase decision, businesses go through a series of approvals. The general process flow starts from requirement gathering, then comes solution consideration, and the final step is evaluation.

- Requirement Gathering

- Solution Consideration

- Evaluation

Business owners must understand and prioritize their requirements before getting into the evaluation stage. This article will take you through the step-by-step process, address all challenges at each stage, and help you find the right solution for your business.

Problem Areas Every Onboarding Solution Must Address

No matter if you are onboarding a vendor or business partner, every onboarding journey has its own set of challenges. We have identified these challenges into three broad categories.

- Onboarding Hassles

- Risk and Compliance

- Scalability

Let’s do a deep dive to understand how the right solution can help businesses overcome these challenges and enable end-to-end seamless and compliant onboarding journeys:

5 points to consider while considering an onboarding solution for your business

1. Communication process flow and Manual Hassles

Challenges: While you are at the planning stage, understand the channels your partners are most comfortable with. What are the alternate mediums you can employ in unforeseen situations? Last but not least, how much of it requires your manual efforts?

Solutions: Many softwares provide DIY Journeys to enable you with automated rolling out invitations to onboard, collect documents with signatures, and store them in a digital repository.

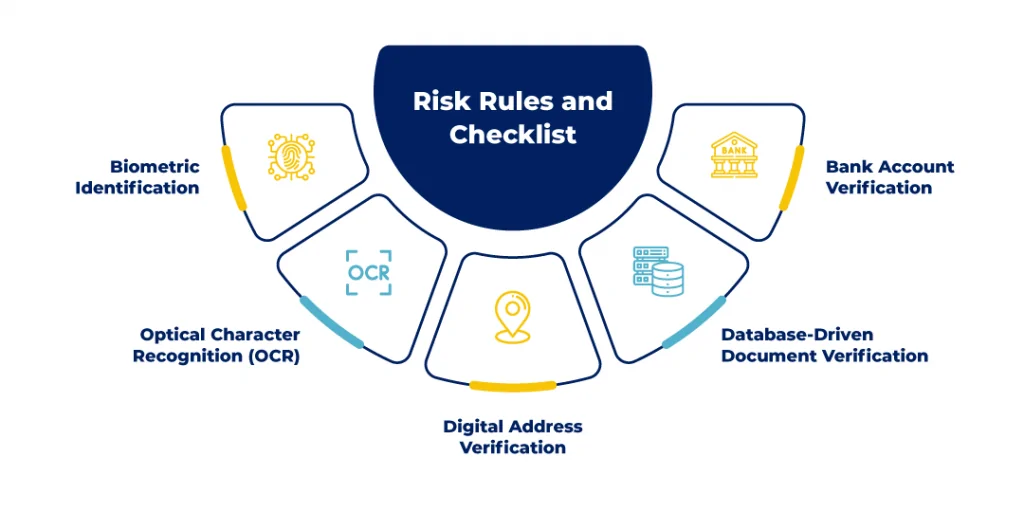

2. Identity checks and Information Insufficiencies

Challenges: There are times when the information provided by the partners is incomplete or they do not have the required documents in place – causing a substantial impact on your plan of scaling fast. So before choosing an onboarding solution, evaluate how well it is suited to vet these processes even before they occur? Does it allow you to choose mandatory, optional, and alternative fields while creating your onboarding workflows?

Solutions: It is imperative to have a comprehensive onboarding solution to conduct identity checks and make complex journeys seamless with the levels of checks we can put in place. The sensitivity of the information and its impact on business adds up to the risk involved in the process. One can choose from various online and offline modes of verification. Online modes always have an edge over offline modes as they reduce unnecessary costs and validate the information with minimum TATs. AI-backed machine learning programs with proprietary database checks have seen higher adoption trends because they are comprehensive and easy to use. Look closely at all the options available in the solution and compare them with your requirements.

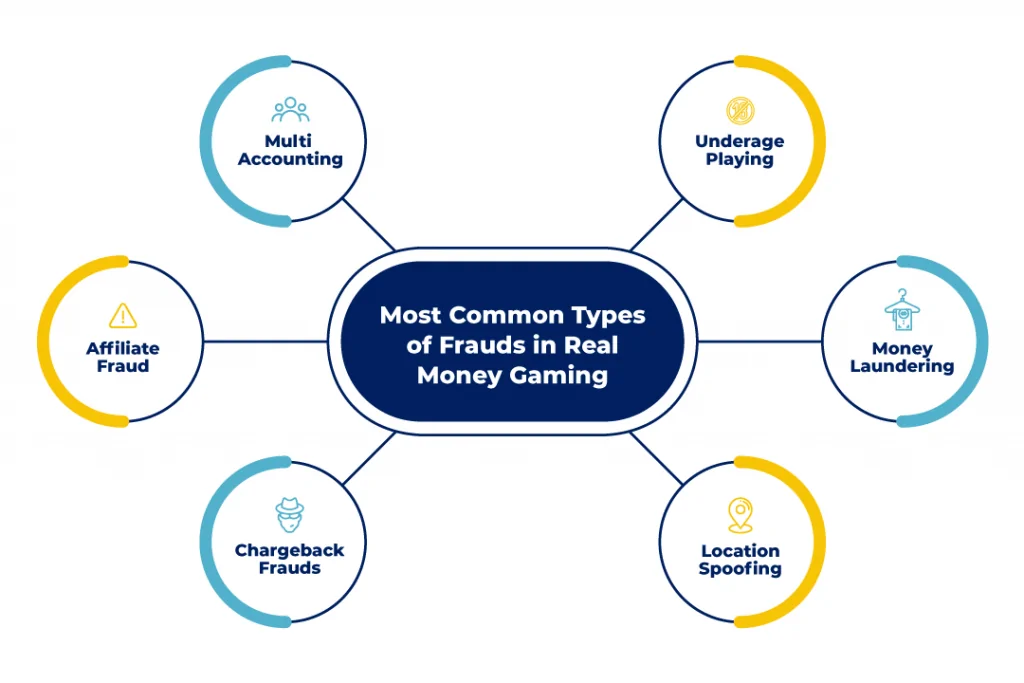

3. Third Party Risk and Compliance

Challenges: You are in a difficult position when you have relevant documents/information but unable to validate its authenticity. Are there certain compliance requirements you have? How can you prevent regulatory, reputational, and financial risks associated with third-party onboarding?

Solutions: Businesses need a single platform to conduct identity and background checks and validate the information against publicly available information or credible national data sources. Manual verification at a scale increases the turnaround time, makes the process tedious, and costs a lot of manhours. Compliance is a differentiating factor among different solutions. Regulatory requirements may vary from industry to industry as defined by the law of the land.

4. Future proof Scalability

Challenges: Is the solution in consideration future proof? What if, in the future, you want to scale as the demand spikes but face technical challenges? What if this leads to a bad customer experience and ultimately results in a loss in revenue?

Solutions: Doing a quick demand estimation and looking at the client portfolio of the solution can help you understand your needs and make an informed decision. Cloud-based solutions are preferred as they enable you to facilitate onboarding at scale at a lower cost, and ensure scalability on the go while improving the service quality.

5. Latest Technology Stack, APIs, and Integration Options

Challenges: It is momentous to consider tech stack, and integrability options otherwise this might deter your operations in the long run. There are chances that you will face challenges while passing down the information from the platform to your in-house ERP or MIS software. Your system also might face challenges while interacting with the platform if the APIs are not standardized.

Solutions: Consider the opinion of your product team before making a final decision on the solution you are planning to use. Make sure you have a clear view of your future scalability needs and potential integrations that you might need in the present as well as future. It is always recommended to opt for technical assistance from vendors while adopting a new solution.

Considering the above points and scoring all the options will help you make a wise choice.

For more information, let our solution specialists help you over a free strategy call. Email us at sales@authbridge.com