KYC or Know Your Customer / Know Your Client is a widely used process in the Financial services sector. From account opening, lending, collections, insurance issuance, and securities trading to fraud and risk management and compliance, KYC is at the heart of customer identification and onboarding. In a country like India — with a large population demographic and varying levels of access to financial institutions — a scalable KYC becomes necessary to drive financial inclusion, profitability, risk mitigation, and compliance.

Considering the growing need for a simple, efficient, time and cost-effective KYC solution for both financial institutions and their customers, most of them digital natives of today, regulatory bodies like the Reserve Bank of India (RBI), the Securities and Exchange Board of India (SEBI), and the Insurance Regulatory and Development Authority (IRDAI) have stepped up to expedite and streamline KYC processes. Allowing for digital modes of verifications, in addition to physical or in-person verification, the regulatory bodies have enabled the BFSI sector to create scalable onboarding solutions, many of them built on top of modern technology. Yet, there are a few caveats to the access and implementation of these solutions.

In this blog, we will discuss the most widely known KYC types and understand their accessibility to financial institutions and compliance safeguards around each of them.

Paper-based KYC

This is an in-person form of verification where customers share physical, self-attested copies of their documents — Proof of Address (POA) and Proof of Identity (POI). Paper-based KYC requires a physical connection with the customer for document collection and signing.

Advantages

This method of KYC is the most traditional way of customer identification. The familiarity of the entire process for both customers and institutions makes this attractive, especially in areas untouched by digitisation.

Access

Any financial organisation can conduct paper-based KYC. There are many third-party experts who can help in navigating operational challenges.

Challenges

The manual nature of the process is cost-intensive and vulnerable to operational delays and inefficiency. The financial institutions face an additional challenge of storing the physical documents and ensuring their upkeep and maintenance. In times of a calamity, like the current pandemic, this process becomes incredibly ineffective.

Aadhaar-based eKYC

The Unique Identification Authority of India (UIDAI) has generated 1.2B+ Aadhaar cards, and these Aadhaar cards have been used for authentication 53B+ times. These statistics make Aadhaar one of the largest identity databases. Aadhaar-based eKYC makes use of this verified data to authenticate customers remotely. There are two ways in which an identity can be verified through Aadhaar — Online Mode: OTP-Based and Online Mode: Biometric-based. OTP-based verification requires customers to have their mobile linked with Aadhaar, whereas biometric-based verification requires UIDAI-verified biometric scanners.

Advantages

This method gives access to an extensive database of verified users. It is 100% digital, hence, faster, and requires no contact with a customer. Aadhaar-based eKYC is also fully compliant with safeguards set by the regulatory bodies.

Access

Aadhaar-based eKYC can be conducted only by banks and telecommunication companies with an AUA/KUA license issued by the UIDAI.

Challenges

Aadhaar-based eKYC demands dedicated technology infrastructure to complete the process effectively. Additionally, this method incurs a high cost when compared to other types of KYC solutions.

Offline KYC

The ‘offline’ in the Offline KYC misleads many to equate it with physical KYC. Offline KYC uses an offline form of Aadhaar without connecting to the UIDAI database. In this form of KYC, an Aadhaar XML/PDF-based or QR-code-based demographic authentication— Name, Address, Gender, DOB, Photograph — can be conducted without the use of biometrics. The XML-based authentication carries a high-resolution photo, but the zipped file can get complicated to download and share with agencies apart from possibility of misuse during transfer. The QR-code mode supports a low-resolution image, and details can be digitally verified through e-Aadhaar on hand-held scanner/mobile apps, making it secure and tamper-proof.

Advantages

Offline KYC is universally accessible to all kinds of private BFSI-entities. Customers must download and share the Offline Aadhaar from the UIDAI website and give their consent to its use for authentications. It is a fast and effective way of KYC where the cost of verification is next to none.

Access

All financial organisations can make use of Offline KYC with the consent and cooperation of their customers.

Challenges

For this method to work, a customer’s mobile phone must be linked to their Aadhaar as the offline Aadhaar download has a step where customers are required to share an OTP received on their mobile.

Digital KYC

Digital KYC involves capturing a live photo of the customer and Officially Valid Documents (OVDs) to be geo-tagged by an authorised officer. An individual can share digital copies of PAN, Aadhaar, or Driving Licence for KYC directly on the institution’s portal or other digital mediums. The Digital KYC process will then only verify the submitted details against the geo-tagged OVDs and not the document’s authenticity.

Advantages

This is a paperless way of onboarding customers by creating a pre-defined digital journey for them. This method cuts down costs drastically through an automated process and creates a seamless onboarding journey for customers.

Access: All banks, NBFCs and FinTech companies can use Digital KYC.

Challenges

The involvement of the RE agent makes the customer identification process dependent on manual intervention, which leads it open to subjectivity and resulting inefficiencies. This method also doesn’t deliver the promise of end-to-end digital onboarding.

Central KYC (CKYC)

Initiated by the Government of India, CKYC is a process that relies on a central repository of customer KYC records in the BFSI sector. This repository allows for inter-usability of KYC records across the financial services sector so that both businesses and customers don’t have to go through the entire process of KYC verification every time they engage with each other. Customers or a financial institution submits a signed CKYC form along with POA and POI. If all checks are in place, the form is processed, and a 14-digit KIN is issued for future transactions.

Advantages

CKYC ensures seamless access to verified KYC documents that could otherwise take days to authenticate. It also detects duplicate accounts, helping in risk mitigation. The customer data is stored in an electronic format. The inter-usability across all financial regulators — RBI, SEBI, IRDA and the Pension Fund Regulatory and Development Authority (PFRDA) — makes it easier for customers to upload documents at one place, leading to customer satisfaction. It is also a cost and time-efficient solution.

Access

CKYC is only available to entities governed/regulated by the Government of India/regulators like RBI, SEBI, IRDA and PFRDA.

Challenges

The KYC documents have to be submitted to the Central Registry of Securitisation Asset Reconstruction and Security Interest (CERSAI) in a paper format in the absence of a digital or paperless onboarding process. Banks will have to undertake the challenging task of updating information on legacy accounts. They will also have to frequently update their records in the CKYC repository as soon as there is a change in the demographic details of a client. Inability to do so may result in a long chain of wrong authentications.

Video KYC

Video KYC refers to assisted/non-assisted KYC via video. It involves an agent and an auditor for verification and audit. Available as Video-based Customer Identification Process (VCIP), Video-based In-Person Verification (VIPV) and Video-based identification Process (VBIP), Video KYC is an entirely paperless and presence less KYC process for a compliant and fraud-free authentication. The customer onboarding process is initiated by submitting the POI and POA and recording a video via an app or a web portal provided by the service provider, which then is manually viewed and verified by an agent.

Advantages

Video KYC creates seamless customer onboarding journeys, enabling end-to-end onboarding. The use of technology to verify the genuineness of documents, the authenticity of individuals, and to match a document to an individual makes Video KYC a nearly error-free process. The onboarding time through Video KYC can be reduced up to 90% while also driving operational and cost-efficiency.

Access

The process is accessible only to banks using OTP-based eKYC and Offline Aadhaar verification and NBFCs and FinTech companies using Offline KYC.

Challenges

Video KYC demands heavy investment in technology if you are not working with a third-party expert. This is where AuthBridge comes in.

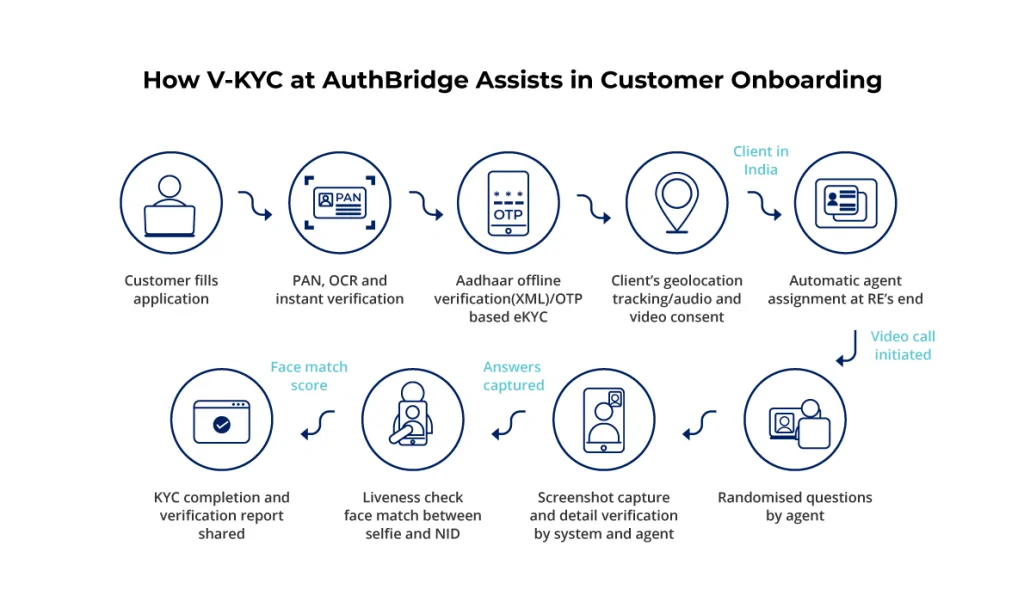

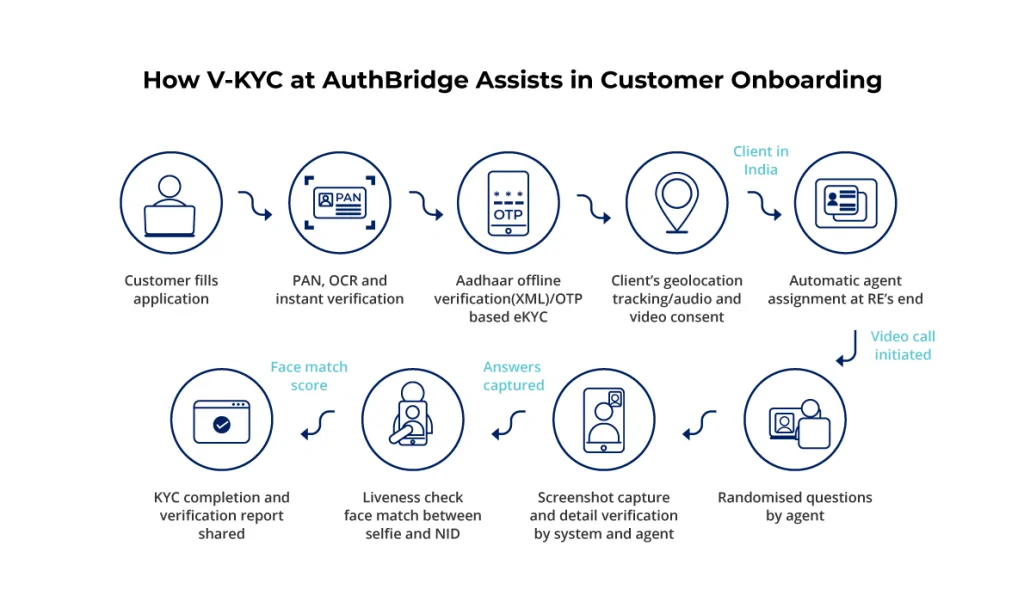

Video-based Customer Identification Process (V-CIP) by AuthBridge is a consent-based method of establishing customer identity. It provides a seamless customer experience via real-time data collection and verification, real-time face match, gesture-based liveness check and geotagging. Swift and economical, AI-powered V-KYC by AuthBridge is a scalable and integration-ready, plug and play product for remote customer identification and authentication within minutes. Compliant with AML/KYC regulations, this V-KYC solution offers customisable workflows to automate checks for customer journeys across different financial products.

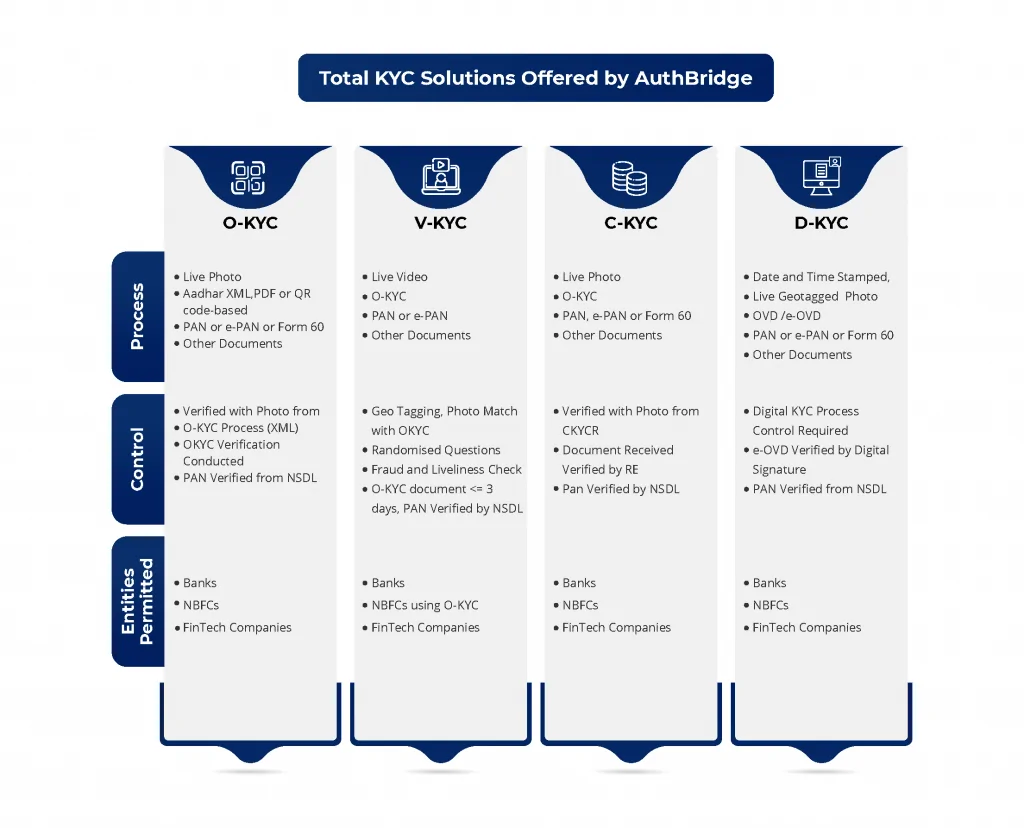

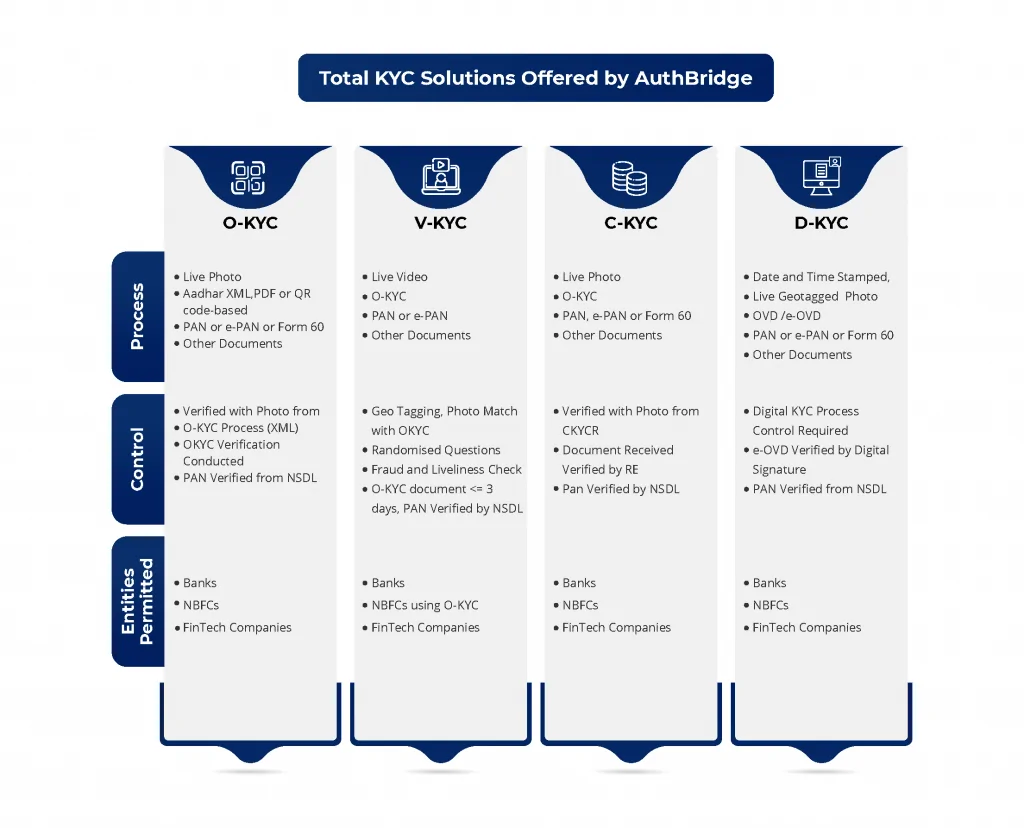

In addition to Video KYC, the suite of Total KYC solutions at AuthBridge also includes Offline KYC (O-KYC), Central KYC (CKYC) and Digital KYC (DKYC). These solutions can be customised as per the need of financial entities.

To find out more about these solutions, you can contact AuthBridge at sales@authbridge.com