Ensuring compliance is one of the cardinal rules for businesses – no matter if it is a large organization or a small enterprise. Enforcing compliance enables businesses to stay in line with fraud prevention policies, detect violations of rules, and protect a company from running into unnecessary fines and lawsuits. To be compliant and stay on the right side of the law, PAN verification is one such important step before onboarding customers, clients, and third parties.

The Permanent Account Number (PAN) card is one of the most important documents nowadays. Issued by the Income Tax Department, the major purpose of this document is to prevent tax evasion by individuals and entities as it links all financial transactions made by a particular individual or entity. It is like an economic tool used to keep tabs on all monetary transactions and maintain a detailed record for ongoing and future compliance purposes.

However, the PAN card has many other uses besides just being a way for the government to keep tabs on an individual/entity’s financial dealings. PAN Card is useful for IT return filings, bank account opening, making investments, and most importantly as a proof of identity – anywhere in the country.

A typical PAN card issued to an individual would comprise the following information:

- The First Name and the Last Name

- Date of Birth

- PAN Number

- Photo

- Signature of the PAN holder

A typical PAN card issued to a business would comprise the following information:

- Company Name

- Date of Incorporation

- PAN Number

Need for Pan Card Verification API

The rising issue of cybercriminals using morph digitized images to dodge the verification process and engaging in cyber frauds has made it imperative to have a stringent verification solution in place. As a result, ascertaining the genuineness of a PAN Card is a cardinal rule for businesses before onboarding individuals and other third parties.

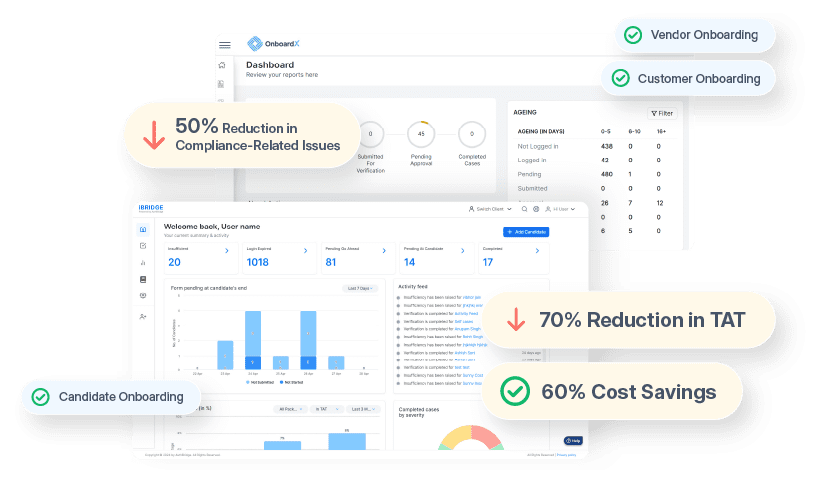

Using an identity verification API fastracks the PAN Card verification process and helps businesses ensure whoever they are onboarding or associating their business with is reliable. API-led verification makes the entire process frictionless, convenient, and instantaneous while also eliminating the need for a KYC official or third party to be physically available at the time of the process.

Companies can save themselves from getting sucked into the whirlpool of manual verification by digitizing verification via APIs. It is also a major game changer in terms of cutting down unnecessary costs and saving time.

AuthBridge’s PAN Verification API

Leveraging AuthBridge’s PAN verification API can make your onboarding process easier and frictionless for your clients, customers, vendors, and other third parties. Our configurable PAN verification API assures convenience by automating the process and enables businesses to conduct verifications in bulk. It cuts the need to invest a good amount of man-hours into PAN card verification and helps organizations to be efficient.

How does it work?

This easy-to-follow process includes uploading the PAN details through API and extracting data in real-time through OCR that gets validated from the Government databases.

Here are some of the reasons to leverage AuthBridge’s PAN Card Verification API.

- Real-Time & Seamless Verification: Our API-led verification assures seamless verification as OCR automatically fetches the details from the documents – cutting the need for manual intervention and delay. The details are retrieved in real time and verified from government databases to reduce the risks associated with identity theft and fraudulent activities.

- Easily Integrate: Our industry-leading APIs ensure seamless integration with your existing workflows and processes. This means smoother communication with your other programs, thereby adding to the efficiency.

- Data Privacy: The details of every individual are completely safe in the API platform as it is completely automated and does not need any third-party assistance.

It empowers businesses and other institutions where officials/third parties cannot commute for in-person PAN verification. Some of the top sectors like BFSI, Retail, FMCG, Pharmaceutical, and many more can leverage AuthBridge’s integrated API technology to onboard more customers, clients, and vendors with instant PAN verification.

AuthBridge is India’s largest authentication and background verification company. With 150+ instant verification APIs, AuthBridge has changed the game when it comes to identity verification in record time. From Aadhaar card verification to GST number verification or getting a CIBIL score report,